Health Insurance

Even the healthiest individuals can get sick unexpectedly and require expensive medical treatment. The inflation rate is very high in the country and medical treatment has become very expensive. Not being financially prepared to cover the cost of necessary medical treatment is not an option in such a situation. This is where a comprehensive health insurance plan comes into play to protect you and your family’s finances. It covers the cost of hospitalization, daycare treatment, ambulance charges, etc.

What is Health Insurance?

Health insurance is also known as medical insurance. A health insurance plan is a contract between the insurance company and the policyholder in which the health insurance company provides you with financial coverage against medical expenses incurred due to accident, critical illness, minor or major injuries, etc.

Policyholders need to pay a pre-determined amount (health insurance premium) to avail the coverage benefits of a health insurance policy. A health insurance plan offers various coverage benefits such as pre and post-hospitalization, home hospitalization, coverage for daycare treatment, annual medical check-up, etc.

Types of Health Insurance

Health insurance can be a savior in the time of a medical emergency. There are 6 different types of health plans available in India to meet your unique healthcare needs. Let us discuss the different types of health insurance plans in detail:

Individual Health Insurance

Individual Health insurance is a type of health insurance plan that offers coverage on an individual basis. This type of health insurance plan covers the cost of medical expenses that arise due to accidents, critical illness, major or minor surgeries. Individual health insurance plans offer comprehensive coverage to an individual at the time of medical emergencies. It covers the cost of in-patient hospitalization, daycare treatments, OPD charges, etc.

Family Floater Health Insurance

Family health insurance is a type of health insurance plan that provides medical coverage to the entire family in a single health insurance plan. A policyholder can cover a maximum of 6 family members (spouse, dependent children, parents, and parents-in-law) under a family health policy. The sum insured amount will be split among all the members covered under the Family Health Insurance plan.

Senior Citizen Health Insurance

Senior citizen health insurance is a type of health insurance plan that provides medical coverage to individuals above the age of 60 years. If you want to buy a health plan for a parent or a senior citizen, you should opt for senior citizen health insurance. A senior citizen health policy covers the cost of medicines, doctor's consultations, pre and post-hospitalization, etc.

Critical Illness Health Insurance

Critical illness health plan is a type of health insurance plan that provides a pre-defined lump sum amount to the insured if he/she is diagnosed with a critical illness such as cardiovascular disease, cancer, renal failure, etc.

Group Health Insurance

Group Health Insurance is a type of health insurance plan that is designed to provide medical coverage to a group of people. Generally, a company or employer provides a group health insurance plan to its employees. Group health plans come with a low premium cost as compared to other health insurance plans. You can add your family members to the same policy. A group health insurance plan covers the hospitalization cost incurred due to injuries, illnesses, accidents, etc.

Top up Health Insurance Plan

Top up health insurance plans act as additional protection for you and your family at the time of medical emergencies. Top up health insurance is a type of health plan that replenished the sum insured amount up to a certain amount. It offers the higher sum insured amount over and above the basic sum insured amount.

How does Health Insurance Work?

Health insurance works by providing financial protection to the insured person in case of a medical emergency. The insured person pays a premium to the insurance company. In return, the insurance company agrees to pay for the medical expenses incurred by the insured person up to the policy limit. In case of a medical emergency, the insured person can either get treatment at a network hospital where the insurance company has a tie-up, or they can get treatment at a non-network hospital and then claim reimbursement for the expenses incurred.

Importance of Health Insurance

As we all know that inflation in India is increasing day by day due to which the treatment is becoming costlier. In such situations, a health insurance plan can play a vital role in everyone's life. Buying a health insurance policy is the only way to deal with these situations and afford quality medical treatment in times of medical emergencies. Given below are some reasons to buy health insurance plans in India:

Lifestyle changes

Health insurance helps you fight against lifestyle diseases such as kidney failure, liver damage, heart disease, cancer, etc. These diseases are common in people over the age of 40 due to a sedentary lifestyle. A health insurance plan not only helps you identify these diseases at an early stage but also helps in providing financial protection in terms of their treatment.

Counter Medical Inflation

As you know, medical treatment is very expensive these days due to the high inflation in the country. A comprehensive health insurance plan helps you deal with this medical inflation as it provides financial protection in case of medical emergencies. Health insurance covers your entire hospitalization expenses such as pre and post-hospitalization charges, room rent, doctor's consultation charges, etc.

Secures Your Entire Family Members

A health insurance plan not only covers you but also provides coverage to your entire family members in a single health insurance policy (Family Health Insurance). Almost every health insurance company in India offers a family health insurance plan that allows you to cover yourself, your spouse, dependent children, your parents, and your parents-in-law. It reduces the hassle of buying multiple health insurance policies for every individual.

Protects Your Savings

A health insurance plan helps you to protect your hard earning savings from hefty medical expenses in case of hospitalization. Only one hospitalization can drain all your life savings. But if you have a health insurance plan to cover all your medical expenses in case of hospitalization, then you can save all your hard-earned money.

Tax Benefits

A health insurance also helps you get tax benefits on the health insurance premium paid by you under Section 80D of the Income Tax Act, 1961.

List of Health Insurance Companies Available in India

There are 28 health insurance companies in India providing health insurance plans. Each health insurance company offers its own health plan with some unique features and benefits. So, we have compiled a list of all the health insurance companies available in India with their claim settlement ratio, solvency ratio, and network hospitals.

| S.No. | Health Insurance Company | Claim Settlement Ratio (2021-22) | Solvency Ratio (2021-22) | Network Hospitals |

|---|---|---|---|---|

| 1. | Acko General Insurance Ltd. | 97.20 | 1.84 | 7,000+ |

| 2. | Aditya Birla Health Insurance Co. Ltd | 99.41 | 1.73 | 10,051 |

| 3. | Bajaj Allianz General Insurance Co. Ltd | 96.59 | 3.43 | 8,000+ |

| 4. | Care Health Insurance Ltd. | 100 | 1.81 | 19,000+ |

| 5. | Cholamandalam MS General Insurance Co. Ltd. | 93.23 | 1.89 | 10,000 |

| 6. | Go Digit General Insurance Ltd. | 96.06 | 1.77 | 10,500+ |

| 7. | Zuno Health Insurance Co. Ltd. | 97.26 | 1.76 | 5,000+ |

| 8. | Future Generali India Insurance Co. Ltd. | 96.01 | 1.61 | 6,000+ |

| 9. | HDFC ERGO General Insurance Co. Ltd. | 98.49 | 1.68 | 13,000+ |

| 10. | ICICI Lombard General Insurance Co. Ltd. | 97.07 | 2.54 | 6,700+ |

| 11. | IFFCO Tokio General Insurance Co. Ltd. | 89.38 | 1.64 | 7,500+ |

| 12. | Kotak Mahindra General Insurance Co. Ltd. | 96.90 | 2.13 | 4,000+ |

| 13. | Liberty General Insurance Ltd. | 97.30 | 2.85 | 5,000+ |

| 14. | Magma HDI General Insurance Co. Ltd. | 92.34 | 1.75 | 7,200+ |

| 15. | ManipalCigna Health Insurance Co. Ltd. | 99.90 | 1.67 | 7,600+ |

| 16. | Niva Bupa Insurance Company | 99.99 | 1.70 | 8,600+ |

| 17. | National Insurance Co. Ltd. | 86.28 | 0.31 | 6,000+ |

| 18. | Navi General Insurance Ltd. | 99.99 | 2.00 | 10,000+ |

| 19. | The New India Assurance Co. Ltd. | 92.93 | 1.84 | 1,500+ |

| 20. | The Oriental Insurance Co. Ltd. | 90.18 | 0.45 | 2,500+ |

| 21. | Raheja QBE General Insurance Co. Ltd. | 93.30 | 2.44 | 5,000+ |

| 22. | Royal Sundaram General Insurance Co. Ltd. | 95.95 | 2.07 | 11,800+ |

| 23. | Reliance General Insurance Co. Ltd. | 98.65 | 1.67 | 8,600+ |

| 24. | SBI General Insurance Co. Ltd. | 95.04 | 1.98 | 20,000+ |

| 25. | Star Health and Allied Insurance Co. Ltd. | 99.06 | 1.70 | 12,000+ |

| 26. | Tata AIG General Insurance Co. Ltd. | 93.55 | 2.14 | 7,200+ |

| 27. | Universal Sompo General Insurance Co. Ltd. | 95.77 | 2.03 | 4,000+ |

| 28. | United India Insurance Co. Ltd. | 97.25 | 0.82 | 2,500+ |

Best Health Insurance Plans in India: Different Categories

Many health insurance companies are offering different types of health insurance plans in India. Finding the best possible health plan in each category can be a daunting task. We RenewBuy can help you buy the best health insurance plan as per your health requirement. We have done an extensive research to list the best health insurance plans in each category of health insurance. Below is the list of some best health insurance plans for each category of health insurance:

Individual Health Insurance Plans

*Disclaimer: We RenewBuy does not endorse any specific insurance company or insurance product offered by any insurer and this list is just an illustration of the plan offered by different health insurance companies

Family Health Insurance Plans

*Disclaimer: We RenewBuy does not endorse any specific insurance company or insurance product offered by any insurer and this list is just an illustration of the plan offered by different health insurance companies

Senior Citizen Health Insurance

*Disclaimer: We RenewBuy does not endorse any specific insurance company or insurance product offered by any insurer and this list is just an illustration of the plan offered by different health insurance companies

Critical Illness Health Insurance

*Disclaimer: We RenewBuy does not endorse any specific insurance company or insurance product offered by any insurer and this list is just an illustration of the plan offered by different health insurance companies

Eligibility Criteria for a Health Insurance Plan

Below mentioned are the common eligibility criteria to buy a health insurance plan:

| Eligibility Criteria | Specifications |

|---|---|

| Entry Age Criteria for Adults | 18 to 65 years |

| Entry Age Criteria for Children | 90 days to 25 years |

| Pre-medical checkup | Above the age of 45/55/60 years |

| Pre-existing Disease (PED) waiting period | 2 years to 4 years |

Benefits of Health Insurance

A comprehensive health insurance plan offers various benefits to you and your family, you need to understand these benefits before buying the health plan. Below mentioned are some of the benefits of a health insurance plan:

Financial Security

Health insurance plans provide all-round financial protection from difficult and unexpected financial upheavals, especially when the cost of medical treatment continues to rise. It is important to buy the right health insurance policy in India if you want to avoid paying huge medical bills or spending money on expensive medicines and medical treatments.

Profitable deals

Health insurance offers various attractive deals if you buy a health insurance plan at an early stage of your life like high coverage at a low premium amount, low waiting period, long policy term, etc.

Cashless Treatment

Health insurance provides the policyholder with cashless treatment at their network hospitals. The policyholder need not worry about arranging cash to pay the hospital bills at the time of hospitalization. The health insurance company will directly settle the medical bills with the hospital.

Income Tax Benefits

You can save money on your taxes by purchasing a health insurance plan. Individuals can claim tax deductions up to INR 1 Lakh under Section 80D of the Income Tax Act, 1961.

Does a Health Insurance Cover COVID-19 Treatments?

As we know, the biggest medical concern in the current world is the COVID-19 pandemic. The Insurance Regulatory and Development Authority of India (IRDAI) has mandated that all health insurance plans must cover the cost of COVID-19 treatment and hospitalization. The cost of hospitalization will be covered by insurance plans if the insured has been hospitalized for more than 24 hours after the diagnosis of COVID-19.

What is Covered Under Health Insurance?

In the below section, you will get an insight into the coverage offered under the health insurance in India:

In-patient Hospitalization

A health insurance plan covers all the hospitalization expenses arising due to any diseases and injury if the insured is admitted to the hospital for more than 24 hours.

Pre-Hospitalization

A health insurance policy covers the medical expenses incurred before the hospitalization of the policyholder for a specific number of days as per the policy terms and conditions.

Post-Hospitalization

A health plan covers the medical expenses incurred after the discharge from the hospital of the policyholder for a specific number of days as per the terms and conditions of the health policy.

Daycare Treatment

A health insurance plans offer coverage for the treatments that can be treated in less than 24 hours of hospitalization such as cataract, chemotherapy, etc.

Domiciliary hospitalization

A health insurance plans cover expenses incurred due to home hospitalization due to the non-availability of medical facilities in hospitals. Domiciliary Hospitalization will be covered if the treatment lasts for more than 3 days.

AYUSH Treatment

A health insurance plan cover various alternative treatments such as Ayurveda, Yoga & Naturopathy, Unani, Siddha, and Homeopathy.

Hospital Daily Cash

The policyholders will get some cash amount each day during the time of hospitalization for a specific period of time as per the terms and conditions of the policy.

OPD Charges

The policyholders will get some cash amount each day during the time of hospitalization for a specific period of time as per the terms and conditions of the policy.

Annual Health Check-up

A health plan offers free annual health checkups to the policyholders.

Preventive Health Check-up

A health insurance plan provides free regular health check-ups to the policyholder which will help him/her maintain a healthy lifestyle.

Lifetime Renewability

A health insurance policy offers lifelong renewability of a health insurance plan without any restriction on the age limit.

Emergency Ambulance

A mediclaim policy covers the charges of ambulance service in case of a medical emergency.

What is not covered under Health Insurance plans?

The following situations and conditions are not covered under Health Insurance Plans:

- Self-inflicted injury

- Dental treatment

- Obesity Treatment

- Abuse of drugs and alcohol

- Adventure sports

- IVF Treatment

- Cosmetic Treatment

- Injuries arise during a war-like situation

- Breach of law/criminal activity

Below mentioned are the benefits that are covered after the waiting period:

| Particular | Waiting Period |

|---|---|

| Pre-existing period | 2-4 years |

| Initial Waiting Period | 30 days |

| Covid-19 treatment | 15 days |

| Grace Period | 15-30 days |

| Free-look Period | 30 days |

Health Insurance Riders

Health insurance riders are used to enhance the basic coverage benefits by paying some extra premium amount. Below mentioned are some of the health insurance riders that you can consider before buying a health insurance plan:

Maternity Rider

you can cover the expenses related to maternity, pre and post-natal expenses and newborn child under a maternity add-on rider.

Critical Illness Rider

The policyholder will receive a lump sum amount on a diagnosis of critical illness during the policy term such as cardiovascular diseases, kidney failure, cancer, etc.

Personal Accident Rider

The policyholder will receive the total amount if he/she becomes completely permanently disabled or partially disabled due to an accident.

Hospital Daily Cash Rider

The policyholder will get a daily cash allowance to take care of additional expenses such as food, travel, etc. at the time of hospitalization of the policyholder.

Reduction of Waiting Period Rider

The policyholder can reduce the waiting period for pre-existing diseases with the help of this rider.

Room Rent Waiver Rider

The policyholder can increase the sub-limit for hospital room rents or opt for no sub-limit under this add-on rider.

Why Buy Health Insurance Online?

In this current era of inflation rate in the country, health insurance can be very beneficial. You can buy your health insurance plan online in India as an online medium offers various benefits to the customers. Mentioned below are the benefits of buying a health insurance plan online:

Safety & Security

The online platform provides a safe and secure environment to the policyholder to make online payments through secure payment gateways.

Time-Saving

Buying a health insurance plan online helps you to save time as you can get health insurance premium quotes in a fraction of time.

Easy Comparison

You can compare various health insurance plans online on the official website of the “RenewBuy”.

Convenient

You can buy your health insurance plan online as per your convenience like from your home, office, etc.

24X7 availability

You can buy your health plan without any time limit as you can get any information about any health plan round the clock.

Less Chances of Error

Buying a health policy online reduces the chances of error as the customer himself fills the required information online.

Factors to Consider While Buying Health Insurance Policy

There are a few key factors that you should consider while buying a health insurance policy in India:

Sum Insured amount

The sum assured in health insurance is the limit up to which the health insurance company will cover your medical expenses under the health insurance policy.

Network Hospitals

Always check the list of network hospitals of the insurer before buying a health insurance plan. There are several hospitals in the country that have tie-up with health insurance companies to facilitate cashless hospitalization to the policyholder.

Waiting Period

Health insurance companies do not offer coverage for every illness from day one. The policyholder needs to wait for some time to raise a claim against those illnesses. Generally, the waiting period clause applies to pre-existing diseases such as heart diseases, diabetes, blood pressure, etc.

Copay Clause

Co-payment is also known as copay in health insurance. This is a certain percentage of the claim amount that you will have to pay for medical expenses. Copay reduces the health insurance premium amount up to a certain limit.

Claim Settlement Ratio

Always check the claim settlement ratio of the health insurance company. This is an important parameter to check the performance of companies as the higher the claim settlement ratio, the higher will be the chances of your claim being settled.

Coverage Benefits

Always check the coverage benefits offered under a health insurance plan. Each health insurance policy offers different coverage benefits, always choose a health plan that meets your health needs. Some of the common coverage benefits are in-patient hospitalization, domiciliary hospitalization, Daycare treatments, etc.

Customer Reviews

Before buying a health insurance policy, you must read the reviews of the health plan and the insurance company. This will help you understand the pros and cons of the policy and the efficiency of the insurance provider when it comes to providing services to the customers.

Network Hospitals

Some Myths About Health Insurance

Health insurance is a complex subject that is often surrounded by misconceptions and myths. These myths can lead to confusion and misunderstandings about how health insurance works, potentially affecting our decisions and choices regarding coverage. It is important to debunk these myths and clearly understand health insurance to make informed decisions about our healthcare. Here, we'll address and debunk some common myths about health insurance.

Myth 1: "I'm young and healthy, so I don't need health insurance."

Myth 2: "Health insurance is too expensive, so I can't afford it."

Myth 3: "All health insurance plans are the same, so it doesn't matter which one I choose."

Myth 4: "I have a pre-existing disease, so I won't be able to get health insurance."

Myth 5: "I can only get health insurance through my employer."

Myth 6: "I don't need to review my health insurance plan annually."

Myth 7: "I can only receive medical treatment from doctors within my health insurance company network."

Myth 8: "Health insurance covers all medical expenses."

Factors Affecting Health Insurance Premium

Below mentioned are the factors that can affect your health insurance premium amount:

- Age

- Gender

- Medical History

- Sum Insured Amount

- Policy Term

- Type of Health Plan

- Additional Riders

- Lifestyle of the Applicant

How to Calculate Health Insurance Premium?

You can calculate the premium of your health insurance policy with the help of a health insurance premium calculator. You just have to enter some personal details like medical history, date of birth, phone number, etc. Based on this information, you will be able to check the estimated health insurance premium that you will have to pay for your health insurance plan. Below mentioned are the steps to calculate your health insurance premium amount:

- Visit the official website of the “RenewBuy”.

- Click on the “Health Insurance” tab.

- Enter the required information such as gender, full name, mobile number, and Email ID.

- Click on the “Get Started” tab.

- Enter the other required information

- The next tab will show you the estimated premium of the health insurance plans.

How to Reduce Health Insurance Premiums?

Reducing health insurance premiums can be beneficial to your overall financial health. While specific strategies may vary depending on your location and health insurance company, here are some general tips that may help you lower your health insurance premiums:

-

Compare Health Plans

Research and compare health insurance plans from different health insurance companies. Look for plans that provide the coverage you need at the lowest premium. Online health insurance calculator tools and RenewBuy advisors can help you find competitive options.

-

Choose a Higher Deductible

The deductible is the amount you must pay out of pocket before your insurance coverage begins. Plans with higher deductibles often have lower premiums. Consider your health needs and financial situation to determine whether a high-deductible plan suits you.

-

Assess Your Coverage Needs

Assess your healthcare needs and choose a health plan that suits your needs. If you rarely visit the doctor or require minimal medical services, a plan with basic coverage may be more cost-effective.

-

Access Preventive Care

Many health insurance plans provide free preventive services such as vaccinations, screenings, and annual checkups. By using these services, you can identify and address potential health issues early, reducing the need for costly treatments in the future.

-

Maintain a healthy lifestyle

Leading a healthy lifestyle can reduce your risk of developing chronic conditions and needing medical care. Many health insurance providers offer wellness programs or discounts for individuals who demonstrate healthy behaviours such as regular exercise, not smoking, and maintaining a healthy weight.

-

Review Your Plan Annually

Review your health insurance plan regularly to ensure it meets your needs. Health insurance companies can change their offers and prices every year. Compare your current plan with other available options during the open enrollment period to determine if there are more cost-effective options

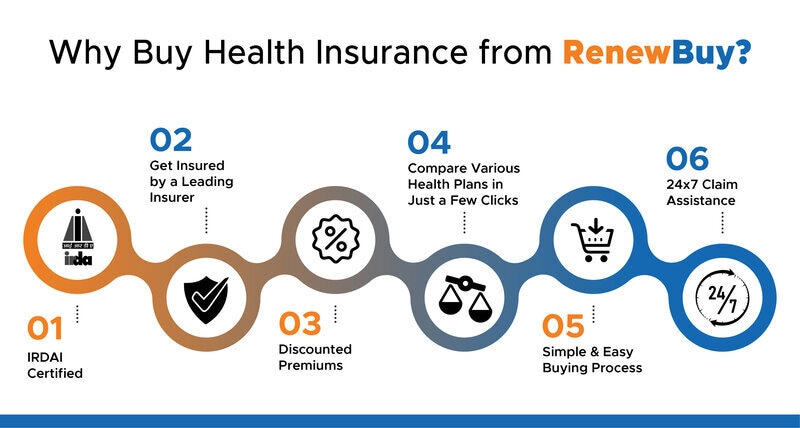

Why Choose Health Insurance From RenewBuy?

Welcome to RenewBuy, your trusted destination for comprehensive health insurance plans. We understand the importance of safeguarding your health and well-being and offer various affordable and reliable coverage options. With our user-friendly platform, you can easily compare policies, get instant quotes, and secure the ideal health insurance plan for you and your loved ones. Below mentioned are some of the reasons to choose RenewBuy to buy your health insurance plan:

- IRDAI Certified

- Get Insured from leading Insurer

- Discounted Premiums

- Compare Various Health Plans in Just a few Clicks

- Simple & Easy Buying Process

- 24x7 Claim Assistance

-

Extensive Coverage Options

At RenewBuy, we provide various health insurance plans tailored to your needs. Whether you're an individual, a family, or a senior citizen, we have comprehensive policies that offer extensive coverage, including hospitalization expenses, pre and post-hospitalization care, ambulance services, and more.

-

Affordable Premiums

We understand that healthcare costs can be overwhelming. That's why we strive to offer health insurance plans with affordable premiums without compromising coverage. With RenewBuy, you can protect your health without breaking the bank.

-

Hassle-Free Claims

RenewBuy is committed to providing a seamless and hassle-free claims process. Our dedicated claims team is available to assist you throughout the entire process, ensuring you receive the support you need when you need it most.

-

Network of Trusted Insurance Providers

We have partnered with leading insurance providers in the industry, ensuring you have access to a vast network of trusted hospitals and healthcare professionals. Enjoy cashless hospitalization and avail the best medical facilities without any financial burden.

-

Customizable Policies

Every individual has unique healthcare requirements. At RenewBuy, we understand this, which is why we offer customizable health insurance policies. Tailor your coverage based on your specific needs, add additional riders, and enjoy the flexibility to adapt your plan as your healthcare needs evolve.

-

Online Convenience

With RenewBuy, you can conveniently browse, compare, and purchase health insurance policies online. Our user-friendly website offers a seamless experience, allowing you to access instant quotes and policy details and make secure online payments.

Health Insurance Buying Process

You can buy a health insurance policy from the insurance company’s official website as well as from “RenewBuy.com”. Below mentioned are both the buying process of health insurance plans:

Buy from the official website of the insurance company

- Visit the insurance company’s official website and click on the “Health Insurance” tab.

- Select the desired plan.

- Fill in all the required information.

- Click on Buy Now button.

- Make payment.

- The insurance company will send the policy documents to your email address.

Buy from “RenewBuy.com”

- Visit the official website of RenewBuy.

- Click on the “Health Insurance” tab.

- Fill out the form that shows on the next page.

- Compare health plans and select your desired plan.

- Click on the “Buy Now” button

- A pop-up will show you the plan details and the additional riders information.

- Click on the “Proceed to Buy” button.

- Make online payment and the policy documents will be sent to your registered email address.

Quick Links

Documents Required For Health Insurance Plan

Below mentioned are the documents required for a health insurance plan in India:

To Buy a Health Plan

- Identity Proof

- Age Proof

- Address Proof

- Medical Report

To Renew a Health Insurance Policy

- Original Health Policy Documents

- Existing Policy Number

- Medical History

To Port a Health Insurance Policy

- ID Proof

- Address Proof

- Medical History

- Original Document of Existing Health Policy

Health Insurance Claim Process

There are two types of claim settlement processes offered under a health insurance plans i.e. Cashless claim process and the Reimbursement claim process.

Cashless Claim Process

- Intimate the insurer within 48 hours of hospitalization

- Fill and submit the claim form

- Submit the other necessary documents

- Once the claim is approved, the insurer will settle the medical bills directly with the hospitals.

Reimbursement Claim Process

- Intimate the insurance company

- Collect the original discharge summary.

- Fill and submit the claim form along with the ID proof

- The insurance company will verify the documents

- Once the verification is done, the insurance company will initiate the reimbursement process.

Health Insurance Renewal Process

You can renew your health insurance policy via two platforms i.e. online and offline. Read below to understand the renewal process of a health insurance policy in detail:

Online Process

- Visit the official website of the insurance company.

- Select "Renewals" from the menu section.

- Enter your policy number and Date of Birth.

- The next page will show you the amount that you need to pay.

- You can also customize your mediclaim plan as per your needs.

- Once you did the Renewal payment, your policy details will be sent to your registered e-mail address.

Offline Process

You can visit the nearest branch of the insurance company and renew your policy from there. Also, you can connect with RenewBuy POSP advisors to get assistance for your health plan renewal.

Understanding Health Insurance Jargons

Here are some common health insurance jargons and their explanations:

- Premium: The amount you pay your insurance company for coverage. It is usually paid every month.

- Deductible: The amount you must pay out of pocket before your insurance coverage starts. For example, if your deductible is INR 1K, you must pay the first INR 1K of covered expenses before your insurance begins to pay.

- Copayment (Copay): A fixed amount you pay for a specific healthcare service, such as a doctor's visit or prescription medication. For example, you might have a copay of $20 for each doctor's visit.

- Network Hospitals:The group of healthcare providers, hospitals, and facilities that have a contract with your health insurance company to provide cashless treatment.

- Preauthorization: The process of obtaining approval from your insurance company before receiving certain medical services or procedures. This is typically required for expensive or non-emergency procedures to ensure they are medically necessary.

- Pre-existing condition: A health condition or illness you had before buying a health insurance plan.

- AYUSH Treatment: It is a type of treatment related to Ayurveda, Yoga and naturopathy, Unani, Siddha and Homoeopathy.

- Domiciliary Treatment: It is a type of treatment in which policyholders can receive treatment at home if they cannot reach the hospital or find medical facilities for a specific treatment under the supervision of a medical professional.

- Free Look Period:This is a period in which you can cancel or change your health insurance company without paying any penalty. Generally, it lasts for 15 days from the date of the policy.

- Restoration Benefit:Restoration benefit refills your sum insured amount if it gets exhausted in a single policy year.

- Add-on Riders:Add-on riders or additional riders are the benefits that you can add to your health plan to enhance the coverage benefits by paying some additional premium amount.