Mediclaim Policy

Mediclaim is a type of health insurance that provides you specified financial protection in a medical emergency. Under a Mediclaim facility, the following expenses are covered:

- In case of an accident

- In case of sudden illness or surgery

- In case of any surgery during the policy tenure

You can avail of the benefits of Mediclaim either through a cashless facility or reimbursement facility.

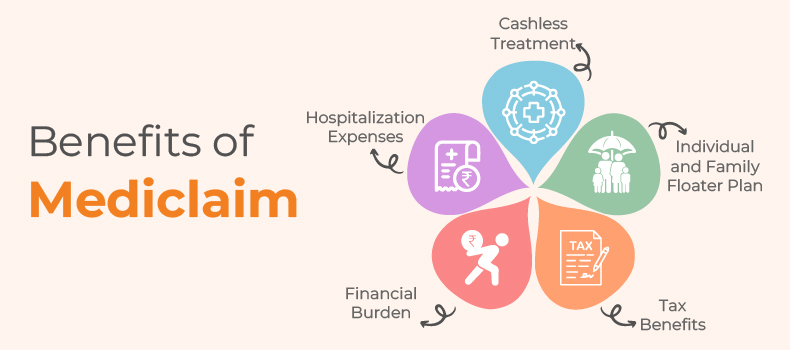

Benefits of Mediclaim

Mediclaim facility provides coverage for expenses arising out of hospitalization. It is beneficial as you will get cover for any medical emergency wherein you need to be hospitalized. Other than this, there are many other benefits of Mediclaim:

Cashless Treatment

Insurance providers in India offer cashless hospitalization facilities at the network hospitals. If there is a medical emergency, you do not have to arrange money, you can get hospitalized, and the insurance company will settle the expenses.

Individual and Family Floater Plan

If you are buying the Mediclaim policy, you have the option of an individual and family floater plan. In the case of an individual plan, only you will get covered, whereas, in a family floater plan, you and your family will also be covered. So, you must see which plan is better for you.

Financial Burden

In case of hospitalization at one of the network hospitals, the insurer will settle the bill. So, you will not have any burden to arrange for the money for the treatment.

Tax Benefits

With Mediclaim insurance, you can save tax on the premium you have paid under Section 80D of the Income Tax Act.

Hospitalization Expenses

Mediclaim plans cover the expenses incurred during hospitalization. This is one of the things that you need to understand about this plan, and it makes the hospitalization cost-effective.

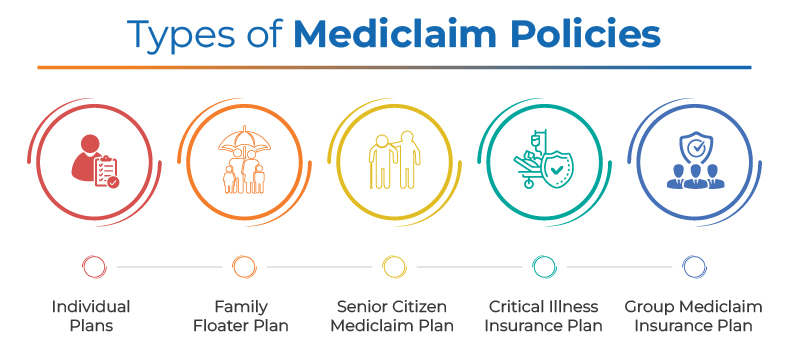

Types of Mediclaim Policies

With more and more companies offering Mediclaim policies that suit various requirements, choosing a suitable Mediclaim facility becomes confusing. For choosing the best Mediclaim plan, you must understand different types of policies.

Let us look at the various policies offered:

Individual Plans

This is the policy for a single person or people who only want the policy for themselves. The policy will cover your medical expenses up to the sum insured.

Family Floater Plan

This type of Mediclaim policy covers the whole family under a single policy and pays a single premium. The policyholder specifies who is included in the policy, including themselves, spouse, children, and parents, if needed.

Senior Citizen Mediclaim Plan

Senior citizen Mediclaim plan offers insurance coverage to people who are 60 years or above with special provisions.

Critical Illness Insurance Plan

Critical illness Mediclaim plans to provide a lump sum amount if the policyholder is diagnosed with a critical illness like kidney failure, cancer, heart attack, etc.

Group Mediclaim Insurance Plan

Group Mediclaim is a health insurance plan that provides coverage to members of a group, society, or organization.

What Does Mediclaim Policy Cover?

These are all the inclusions in the coverage benefits that you will get after buying a Mediclaim. These are the inclusions in a Mediclaim policy that you must know about:

-

Hospitalization Expenses

Mediclaim plans cover the expenses incurred during hospitalization. The expenses that are covered include room rent, doctor’s fee, medicine costs, etc.

-

Pre-and Post-Hospitalization Expenses

It covers the medical expenses incurred due to an illness before getting hospitalized and the expenses of follow-up treatment after getting discharged. The pre-and post-hospitalization expenses are covered up to a specific number of days before and after hospitalization.

-

Day Care Expenses

It also covers expenses incurred on a treatment that requires hospitalization for at least 24 hours. But Mediclaim plans cover only a specific number of daycare procedures as stated in the policy.

-

ICU Charges

A policy also covers the cost of treatment undertaken in an ICU or Intensive Care Unit during the time of hospitalization.

-

Doctor’s Fee

Doctor's charges or medical practitioner's charges are covered under the Mediclaim policy.

Quick Links

What Does Mediclaim Policy Not Cover?

Mediclaim exclusions refer to the expenses that are not covered under the Mediclaim policy. These include:

War, Terrorism, and Nuclear Activity

This insurance policy does not cover any medical emergency caused due to war, terrorism, and nuclear activity.

Sexually Transmitted Diseases or AIDS

AIDS or similar diseases are not covered under a Mediclaim policy. The insurance company will also not pay for diseases or disorders resulting from unhealthy lifestyles or habits such as excessive drinking, drug abuse, or prescription medication abuse.

Cosmetic Surgery

Cosmetic and plastic surgeries are not covered under the policy. However, if cosmetic surgery is required due to an accident, some policies do cover these expenses.

Eye and Dental Surgery Expenses

Eye and dental surgeries are not covered under the policy. Though some insurance policies do have dental and eye care provisions, their scope may be limited.

Diagnostic Tests

Diagnostic tests other than the ones that are taken during hospitalization are not covered under the policy.

*It is essential to read the policy wordings carefully to know all the exclusions in the policy.

Maternity and neonatal care

This plan will not usually cover expenses incurred for pregnancy, delivery, abortion, miscarriage, and other obstetric expenditures. Complications for the mother or child after birth, such as neonatal ICU or emergency surgery, are also not covered.

Pre-Existing Illness

Pre-existing illness is not covered under the Mediclaim policy.

Difference between Mediclaim and Health Insurance

There are some essential differences between Mediclaim and health insurance that you must understand. These differences include:

| S. No | Mediclaim | Health Insurance |

|---|---|---|

| 1 | Mediclaim provides coverage against hospitalization expenses, i.e., you can only avail of the benefits when you are hospitalized. | Health insurance provides comprehensive cover that is not limited to hospitalization. It also covers expenses for OPD, daily hospital cash, etc. |

| 2 | Mediclaim does not have any add-on covers. | You can buy various add-on covers in health insurance like critical illness cover, maternity cover, etc. |

| 3 | The hospitalization cover provided under the Mediclaim policy is limited. | Health insurance is extensive, and you can choose the coverage amount according to your own needs. |

| 4 | Mediclaim is not flexible, and you cannot customize it. | Health insurance is flexible, and you can customize it according to your own needs. |

Network Hospitals

Key Factors to Consider Before Buying a Mediclaim Insurance Policy

There are a few things that you must consider before buying the policy for yourself. These factors include:

Scope of Coverage

The coverage benefits under the policy and the sum insured will decide the types of expenses that you can claim under the policy. You must read all the information and check whether the policy covers hospitalization expenses, Covid-related hospitalization, etc.

Adequate Sum Insured

Sum insured is one of the critical factors to consider while buying a policy. Before you buy a policy, you need to decide on the sum insured that is adequate to use the benefits properly.

Policy Type

You can choose the policy according to your requirements. The various options include a family floater plan, individual Mediclaim insurance plan, senior citizen Mediclaim insurance, etc.

Copayment Clause

There might be a copayment clause in your insurance policy. This means that a certain portion of claim amount needs to be borne by you. The copayment clause does not influence the sum insured. Although the copayment clause might reduce the premium up to some extent, your out-of-pocket expenses will also increase.

Cashless Hospitals

It is essential to check the network of cashless hospitals of the insurer. If you have a significant number of network hospitals near you, it is always beneficial to help you avail of cashless hospitalization.

Claim Settlement Ratio

This is an important criterion that you can consider while buying a policy. You can check the Claim Settlement Ratio of different companies so that you can choose the right company.

Conclusion

Mediclaim policy is one of the best plans that you require to cover your hospitalization expenses. Before buying the policy, you need to read the terms and conditions to know all the rules and regulations mentioned in the policy.