Retirement planning is an important aspect of financial well-being, ensuring that individuals can maintain their standard of living even after they stop working. However, millions of individuals in India, especially those working in the unorganized sector, need access to formal pension schemes. The Government of India launched the Atal Pension Yojana (APY) in 2015 to address this gap and provide a social safety net.

Atal Pension Yojana (APY)

APY aims to provide a sustainable pension income to individuals in the unorganized sector, enabling them to live a dignified life during their golden years. In this article, we will explore the details and benefits of Atal Pension Yojana, including eligibility criteria, contribution structure, government co-contribution, portability, withdrawal options and the broader impact of the scheme on the Indian population.

What is Atal Pension Yojana (APY)?

Atal Pension Yojana (APY) is a government-backed pension scheme administered by the Pension Fund Regulatory and Development Authority (PFRDA). It was launched to provide a defined pension to individuals working in the unorganized sector who are not covered under any formal pension scheme. APY helps bridge the gap in retirement planning by encouraging individuals to contribute to their pension fund during their working years, thereby ensuring a regular income flow after retirement.

Atal Pension Yojana (APY) Eligibility Criteria

Atal Pension Yojana (APY) is available to all Indian citizens between the ages of 18 and 40. Individuals must have a valid savings bank account and provide their Aadhaar card as proof of identity to enrol in the scheme. The scheme is open to everyone, regardless of occupation or employment status. Broad eligibility criteria make APY accessible to many of the Indian population.

Key Features of Atal Pension Yojana (APY)

The government of India established the Atal Pension Yojana to provide guaranteed monthly pension to all Indians after the age of 60. Here are some key features of APY:

- It targets the poor, underprivileged and the workers in the unorganized sector. It is regulated by the PFRDA (Pension Fund Regulatory and Development Authority) through the NPS (National Pension System) structure.

- It provides the scheme subscribers a guaranteed minimum monthly pension of INR 1K to INR 5K (in multiples of INR 1K) per month.

- The Indian government is committed to safeguarding the minimum pension amount. If pension contributions fall short of generating the anticipated returns to fulfil the minimum guaranteed pension, the government will allocate the required funds to bridge the gap.

- If the returns on pension contributions surpass the expected returns for the minimum guaranteed pension, the excess amount will be credited to the subscriber's account throughout the contribution period. Consequently, this will enhance the scheme's benefits to the subscribers by increasing their accumulated funds.

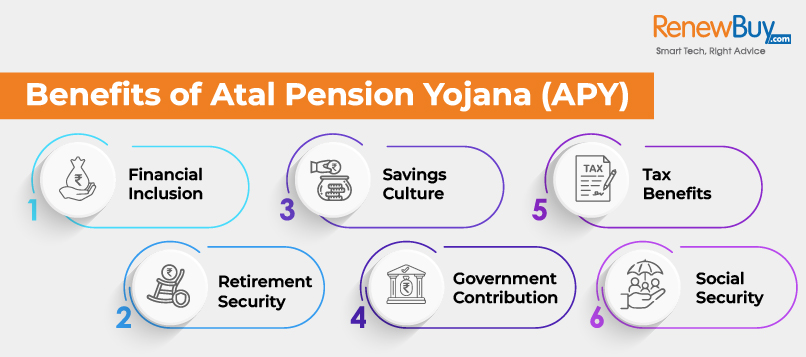

Benefits of Atal Pension Yojana (APY)

The Atal Pension Yojana has significantly impacted retirement planning in India, especially for individuals in the unorganized sector. Some of the key benefits and impacts of APY are as follows:

- Financial Inclusion: APY has extended the benefits of formal pension schemes to a large section of the population who were previously excluded from such schemes. It has facilitated financial inclusion and provided a social safety net to those working in the unorganized sector.

- Retirement Security: By encouraging regular contributions to the pension fund, APY ensures that individuals have a reliable income source during their retirement years. This income can be used to cover living expenses, health care costs, and other essential needs.

- Savings Culture: APY promotes a savings culture among individuals in the unorganized sector, fostering the habit of long-term financial planning. By contributing to the scheme, customers develop the discipline of saving and investing in their future, which can positively impact their overall financial well-being.

- Government Contribution: Government co-contribution to APY subscribers' accounts significantly enhances their pension corpus. This co-contribution encourages individuals to actively participate in the plan and build a more adequate retirement fund.

- Tax Benefits: APY contributions are eligible for tax benefits under section 80CCD of the Income Tax Act. This provides additional financial incentives for individuals to join the plan and save for their retirement.

- Social Security: APY contributes to the overall social security of the nation by ensuring that individuals in the unorganized sector have a reliable pension income. It reduces the burden on the government to provide financial assistance to retired persons, promoting self-reliance and independence.

Atal Pension Yojana (APY) Monthly Contribution Chart

Atal Pension Yojana (APY) is a pension scheme supported by the Government of India to ensure the financial stability of individuals during old age. The subscriber's age at the time of enrollment determines the monthly contribution and desired pension amount for this scheme. Below is a detailed analysis:

Enrollment Age

The monthly contribution depends on what age you join the Atal Pension Yojana (APY):

- If you join between 18 and 40 years old, the contribution varies based on the chosen pension amount.

- If you join after the age 40, you must make higher contributions.

Pension Amount

APY offers different pension amounts: INR 1K, INR 2K, INR 3K, INR 4K, and INR 5K per month. You can choose the pension amount you desire at the time of enrollment.

| Monthly Pension (INR) | Age of Enrollment | Monthly Contribution (INR) |

|---|---|---|

| 1K | 18 | 42 |

| 1K | 35 | 181 |

| 2K | 18 | 84 |

| 2K | 35 | 362 |

| 3K | 18 | 126 |

| 3K | 35 | 543 |

| 4K | 18 | 168 |

| 4K | 35 | 724 |

| 5K | 18 | 210 |

| 5K | 35 | 904 |

Government Co-Contribution

For those who join the scheme between the ages of 18 to 40 years and are not covered under any statutory social security scheme, the Government of India will pay 50% of the subscriber's contribution or INR 1K per annum (whichever is lower) for 5 years.

Payment Modes

Subscribers will choose the mode of payment as per their convenience, as it can be done monthly, quarterly or half-yearly. Contributions are usually auto-debited from the customer's bank account.

Atal Pension Yojana (APY) Withdrawal Process

While the initial provision of Atal Pension Yojana (APY) allowed withdrawals only after reaching the age of 60 years, the withdrawal process has been slightly modifications:

- Now, if you reach the age of 60, you have the option to exit the scheme and receive the full annual pension. To start this process, you need to visit your bank and submit an application for pension withdrawal.

- In exceptional circumstances, such as terminal illness or death, it is possible to exit the scheme before reaching the age of 60. In case of your death before the age of 60 years, your spouse will be entitled to receive the pension. If you and your spouse die, the nominee you appoint will receive the pension payment.

Penalties for Late Payments of Contribution

In case of delayed payments, the Atal Pension Yojana (APY) imposes the following penalty charges every month:

- For monthly contributions up to INR 100, a penalty of INR 1 will be levied.

- If the monthly payment ranges between INR 101 and INR 500, a penalty of INR 2 will be imposed.

- Contributions falling within INR 500 and INR 1K per month will be subject to a penalty of INR 5.

- If the monthly payment exceeds INR 1K, a penalty of INR 10 will be charged.

Key Things to Remember About the Atal Pension Yojana (APY)

Atal Pension Yojana (APY) is a government-backed pension scheme that provides financial security to individuals during their old age. Here are some key things to know about the scheme:

- Eligibility: APY is open to all Indian citizens aged between 18 to 40 years. Individuals must have a valid savings bank account and provide their Aadhaar card as identity proof.

- Contribution Structure: Subscribers contribute a fixed amount to their pension fund, which is determined based on their age at the time of enrollment and desired pension amount. This scheme offers five monthly pension slabs ranging from INR 1K to INR 5K.

- Government Co-contribution: The government provides co-contribution to eligible APY subscribers. It co-contributes 50% of the subscriber's contribution or INR 1K per year (whichever is lower) for a period of 5 years for those who joined the scheme between 2015 and 2019.

- Minimum Guaranteed Pension: APY ensures the subscribers a minimum guaranteed pension amount. If the actual return on contributions falls short, the government will provide the necessary funds to make up that shortfall.

- Withdrawal Options: Initially, withdrawals from APY were limited to individuals above 60 years of age. However, modifications have been made to this, and now subscribers can opt for full annuitization of their pension when they reach the age of 60 years. In exceptional circumstances, such as terminal illness or death, premature withdrawal is advisable.

- Portability: APY offers portability, allowing subscribers to continue their contributions and receive their pension even if they move to another part of the country. Subscribers can also change their bank accounts or contribution frequency if required.

- Nomination and Family Benefit: APY subscribers must provide details of a nominee who will receive the accumulated pension amount in case of the death of the subscriber. If the subscriber dies before the age of 60 years, the spouse is entitled to receive the pension. After the subscriber's and spouse's demise, the accumulated amount is passed on to the nominee.

- Impact and Benefits: APY has significantly impacted retirement planning in India, especially for individuals in the unorganized sector. It promotes financial inclusion, retirement security and a savings culture. Additional benefits of the scheme are government co-contribution, tax benefits and overall social security.

Conclusion

The Atal Pension Yojana (APY) has emerged as a vital initiative in India's quest for comprehensive social security. APY addresses the long-standing retirement planning issue in this population segment by providing a formal pension scheme to individuals working in the unorganized sector. The scheme's affordability, flexibility, and government co-contribution make it an attractive option for millions of Indians seeking to secure their financial future. As APY continues to gain traction and awareness, it is expected to have a lasting impact on the lives of individuals, empowering them to retire with dignity and financial stability. With the government's support and the participation of individuals, APY paves the way for a more inclusive and secure retirement landscape in India.

Some Other Government Schemes in India

Mukhyamantri Chiranjeevi Swasthya Bima Yojana

Sukanya Samriddhi Yojana (SSY)

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

Ayushman Bharat Yojana (PMJAY)

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Mahatma Jyotiba Phule Jan Arogya Yojana - MJPJAY

Related Article

Top 10 Life Insurance.....

IRR In Insurance

Surrender Value in.....

Viklang Pension Yojana: Eligibility,.....

How to Check Ladli.....

How to Check Chief.....

Top 10 Pension.....

Government Life Insurance Schemes.....