Sukanya Samriddhi Yojana (SSY) was launched on January 22, 2015, under the ‘Beti Bachao, Beti Padhaao’ campaign. The scheme addresses the issue of rising female foeticide and declining girl-child ratio in India. By investing in the child insurance plan, the parents can systematically plan the future of their girl child.

Sukanya Samriddhi Yojana (SSY): SSY Scheme Eligibility, Interest Rate, and Tax Benefits

Sukanya Samriddhi Yojana (SSY): An Overview

This article discusses the Sukanya Samriddhi Yojana (SSY) features, benefits, eligibility criteria, and application process for the scheme.

What is Sukanya Samriddhi Yojana (SSY)?

Sukanya Samriddhi Yojana (SSY) is a savings-oriented scheme jointly run by the Ministry of Women & Child Development, the Ministry of Health & Family Welfare, and the Ministry of Human Resource Development. Parents or legal guardians can open a Sukanya account for a girl child aged 10 or below in a private or public sector bank.

The parent can deposit a minimum of Rs. 250/- to a maximum of Rs. 1.5 Lakh annually towards the Sukanya Samriddhi Yojana (SSY). Interest is compounded on the amount deposited under the Sukanya Yojana at a fixed interest rate annually. The scheme ensures a financially secure future for a girl child.

The tenure of the Sukanya Samriddhi Yojana (SSY) is 21 years and can be prematurely closed in case of marriage after the girl child completes 18. The investor can use the Sukanya Samriddhi Yojana (SSY) calculator to calculate the total maturity and investment amount while purchasing or during the tenure.

Sukanya Samriddhi Yojana (SSY) Highlights

The following are the key highlights of the SSY scheme you can consider when planning to buy Sukanya Samriddhi Yojana (SSY) for your girl child and secure her future.

| Sukanya Samriddhi Yojana Features | Particulars |

|---|---|

| Account Type | Small Savings Scheme |

| Interest Rates | 8% annually (revised quarterly) |

| Minimum Deposit Amount Annually | Rs. 250/- |

| Maximum Deposit Amount Annually | Rs. 1.5 Lakh |

| Maturity Span | 21 years |

| Investment Period | Till 15 years from the date of account opening |

| Tax Benefits | Upto Rs. 1.5 Lakh annual |

| Available Centers | 25 banks and post offices |

What are the Objectives of Sukanya Samriddhi Yojana (SSY)?

Sukanya Yojana helps parents build sufficient funds and secure a bright future for girls in India. Here are the primary objectives of the Sukanya Samriddhi Yojana (SSY)

- Demolish the gender discrimination in India

- Ensure the protection and survival of the girl child

- Empower the girl child and promote higher participation

- Encourage the girl child to gain quality education

- Streamline a path to equal opportunities for girls

- Provide a financial cushion for girls and their parents

What are the Eligibility Criteria of Sukanya Samriddhi Yojana (SSY)?

The Sukanya Samriddhi Yojana (SSY) is crafted for the development of a girl child. A parent or guardian is required to consider the following eligibility criteria to apply for Sukanya Samriddhi Yojana (SSY).

Age: The girl child must be 10 years or younger to be eligible for Sukanya Samriddhi Yojana (SSY). Also, a grace period of 1 year is provided, which extends the application period for the SSY scheme, making a girl child upto 11 years eligible for the scheme purchase.

Who Can Apply for SSY Scheme?: Biological parents or legal guardians can open and operate a Sukanya Samriddhi Yojana (SSY) account in the name of the girl child. After the girl child turns 18, she can operate her Sukanya Samriddhi Yojana (SSY) account by herself after submitting the required documents.

How Many SSY Accounts Can I Open?: Only one SSY account in the name of the girl child is allowed. A person having twins or two girl children can open two different SSY accounts. At most, two accounts are allowed to operate. Third Sukanya Samriddhi Yojana (SSY) account is only allowed for one girl child and later-born twin girl children or vice versa. Take the help of the Sukanya Samriddhi Yojana (SSY) calculator to calculate the total savings and interests.

What are Sukanya Samriddhi Yojana (SSY) Benefits?

An Indian girl residing within the country throughout the scheme tenure (for 21 years) is considered the Sukanya Samriddhi Yojana (SSY) beneficiary. The parent opens and manages the Sukanya account until the girl child turns 18. If the depositor exceeds the maximum limit of Rs. 1.5 Lakh annually, then there’s no interest on the amount, but the depositor has the right to withdraw the exceeding money anytime.

Let’s examine the Sukanya Samriddhi Yojana (SSY) benefits and how they impact a girl's life and the family that is connected to her.

Highest Interest of SSY: Compared to other Small Savings Schemes currently running in India, the Sukanya Samriddhi Yojana (SSY) provides the highest interest rate and maximum returns. The government revises the interest rate every quarter and annually adds to your previous Sukanya Samriddhi Yojana (SSY) investment. This way, the investor can increase the investment by multiple times.

Tax Benefits under Sukanya Samriddhi Yojana (SSY): Sukanya Samriddhi Yojana (SSY) helps save taxes, and the guardian/ parents can claim tax benefits upto Rs. 1.5 Lakh under section 80C of the Income Tax Act, 1961.

Guaranteed Maturity Benefits: Your girl child receives a lump sum maturity amount upon Sukanya Samriddhi Yojana (SSY) maturity. This amount includes total investment and interest accumulated on the definite interest rate.

Long-term Financial Security with Sukanya Yojana: The Sukanya Samriddhi Yojana (SSY) focuses on securing the two major milestones of a girl’s life: education and marriage. Once the SSY Yojana account matures after 21 years or pre-mature due to marriage after 18 years, the accumulated amount becomes an asset for financial stability during marriage, education, and entrepreneurship. Also, parents can withdraw 50% of the total amount to finance the education of the girl child only after submitting the proof of admission.

Flexible Investment: The legal guardian or the biological parent can deposit any amount ranging between Rs. 250/- to Rs. 1.5 Lakh as per their financial capabilities and preferences. The Sukanya Samriddhi Yojana (SSY) calculator can calculate the estimated investment, profits, and yearly interest rate.

What are the Important Features of the Sukanya Samriddhi Yojana (SSY)?

The Sukanya Samriddhi Yojana (SSY) 's main objective is to achieve the girl child's financial security. Look at the features of the Sukanya Yojana that make it a unique child plan:

| Easy Account Operation | The parent can reach the nearest public sector bank or authorized post office to open a Sukanya Samriddhi Yojana (SSY) account in the name of the girl child anytime before she turns 10. When the girl turns 18, she can own the rights to operate the SSY account after submitting the required documents to the dedicated bank or post office. |

| Policy Tenure | The total time period of Sukanya Samriddhi Yojana (SSY) is 21 years from the date of opening of the account. The depositor (parent or guardian) must deposit money only for 15 years. The account matures after the completion of 21 years, and the girl child receives the accumulated amount, including the interest. |

| Irregular Deposits | When the Sukanya Samriddhi Yojana (SSY) account is opened, the parent must submit a minimum of Rs. 250. Later, they can deposit a minimum of Rs. 250/—to Rs. 1.5 Lakh within one financial year of the SSY. |

| Revival | The account is considered default if the parent or guardian fails to deposit the minimum amount of Rs. 250/- in any financial year. However, the Sukanya Samriddhi Yojana (SSY) account can be reactivated after paying the minimum amount and required penalty as applicable. |

| Withdrawal | To finance the education of the girl child, the parent can withdraw upto 50% of the outstanding amount at the end of the financial year. Partial withdrawal under the SSY scheme is only allowed after the account holder (girl child) turns 18 or has passed 10th grade, whichever is earlier. |

| Account Closure | The Sukanya Samriddhi Yojana (SSY) account can be closed after the completion of the maturity period, which is 21 years from the date of account opening. At the time of account closure, the outstanding amount with the interest is payable to the account holder. |

| Premature Closure | Closure of the SSY account before the completion of 21 years is possible in the following cases-

|

| Mode of Payment |

|

| Lock-in Period | Whichever is of the below is earlier:

|

| Convenient Transfer | Sukanya Yojana account can be easily transferred from one state to another and banks to post offices and vice versa. |

Know more about the top 10 life insurance companies in India. Check the claim settlement ratio of life insurance and general insurance companies to make an informed decision.

What is Interest Rate of Sukanya Samriddhi Yojana (SSY)?

Currently, the interest rate of Sukanya Samriddhi Yojana (SSY) for quarter 2 (July to September) is set to 8% annually, the highest interest rate among all Small Savings Schemes.

- The government regularly reviews and revises the Sukanya Samriddhi Yojana's (SSY) interest rate quarterly.

- Interest is compounded on the amount deposited and credited to the account balance at the end of every financial year.

- No interest is provided in case the girl no longer remains an Indian citizen (becomes NRI).

Let’s look at the Sukanya Samriddhi Yojana (SSY) interest rate from its inception to give you a better vision and help you gain maximum benefits for your child.

| Scheme Period (Quarterly) | Interest Rate (in %) |

|---|---|

| 03/12/2014 to 31/03/2015 | 9.1 |

| 01/04/2015 to 31/03/2016 | 9.2 |

| 01/04/2016 to 30/09/2016 | 8.6 |

| 01/10/2016 to 31/03/2017 | 8.5 |

| 01/04/2017 to 30/06/2017 | 8.4 |

| 01/07/2017 to 31/12/2017 | 8.3 |

| 01/01/2018 to 30/09/2018 | 8.1 |

| 01/10/2018 to 30/06/2019 | 8.5 |

| 01/07/2019 to 31/03/2020 | 8.4 |

| 01/04/2020 to 31/03/2023 | 8.0 |

| 01/04/2023 to 30/06/2023 | 8.0 |

| 01/07/2023 to 30/09/2023 | 8.0 |

How Does Sukanya Samriddhi Account Work?

Sukanya Yojana is a long-term scheme like any other child plan oriented to provide an opportunity to invest and secure the future of the girl child. Let’s understand the Sukanya Samriddhi Yojana (SSY) with an example.

Say, Mr. Lalwani purchased the Sukanya Samriddhi Yojana (SSY) for his daughter, Inaya, when she turned 5. The Sukanya Samriddhi Yojana works as:

- Mr. Lalwani will have to make contributions for 15 years in one-time annual amounts or instalments until Inaya turns 20.

- Once the 15 years are completed, contributions for the next 6 years (between 16 and 21) are voluntary, but the interest will be calculated based on the previous amount.

- The SSY account will mature after 21 years when Inaya completes 26.

- In case, Inaya gets married after 18 years, Mr. Lalwani can opt for premature closure of Sukanya Samriddhi Yojana.

- When Inaya turns 26, Mr. Lalwani or Inaya herself can withdraw the entire amount with the compounded interest. Partial withdrawals are also permitted to fund the education of the girl child.

Let’s see how the investment grows during the 21-year period of the Sukanya Samriddhi account.

Say, Mr. Lalwani invested 1 Lakh every year for 15 years.

Annual Investment Amount- Rs. 1 Lakh

Interest Rate- 7.6%

Investment Tenure- 15 years

| Year | Deposit Made | Previous Balance | Interest Amount | Investment Value |

|---|---|---|---|---|

| 1 | Rs. 1,00,000 | Nil | Rs. 7,600 | Rs. 1,07,600 |

| 2 | Rs. 1,00,000 | Rs. 1,07,600 | Rs. 15,777.60 | Rs. 2,23,378 |

| 3 | Rs. 1,00,000 | Rs. 2,23,378 | Rs. 24,576.72 | Rs. 3,47,955 |

| 4 | Rs. 1,00,000 | Rs. 3,47,955 | Rs. 34,044.60 | Rs. 4,82,000 |

| 5 | Rs. 1,00,000 | Rs. 4,82,000 | Rs. 44,232 | Rs. 6,26,232 |

| 6 | Rs. 1,00,000 | Rs. 6,26,232 | Rs. 55,193.64 | Rs. 7,81,426 |

| 7 | Rs. 1,00,000 | Rs. 7,81,426 | Rs. 66,988.32 | Rs. 9,48,414 |

| 8 | Rs. 1,00,000 | Rs. 9,48,414 | Rs. 79,679.52 | Rs. 11,28,094 |

| 9 | Rs. 1,00,000 | Rs. 11,28,094 | Rs. 93,335.16 | Rs. 13,21,429 |

| 10 | Rs. 1,00,000 | Rs. 13,21,429 | Rs. 1,08,028.56 | Rs. 15,29,458 |

| 11 | Rs. 1,00,000 | Rs. 15,29,458 | Rs. 1,23,838.80 | Rs. 17,53,297 |

| 12 | Rs. 1,00,000 | Rs. 17,53,297 | Rs. 1,40,850.60 | Rs. 19,94,148 |

| 13 | Rs. 1,00,000 | Rs. 19,94,148 | Rs. 1,59,155.28 | Rs. 22,53,303 |

| 14 | Rs. 1,00,000 | Rs. 22,53,303 | Rs. 1,78,851 | Rs. 25,32,154 |

| 15 | Rs. 1,00,000 | Rs. 25,32,154 | Rs. 2,00,043.72 | Rs. 28,32,198 |

| 16 | Nil | Rs. 28,32,198 | Rs. 2,15,247 | Rs. 30,47,445 |

| 17 | Nil | Rs. 30,47,445 | Rs. 2,31,605.88 | Rs. 32,79,051 |

| 18 | Nil | Rs. 32,79,051 | Rs. 2,49,207.84 | Rs. 35,28,259 |

| 19 | Nil | Rs. 35,28,259 | Rs. 2,68,147.68 | Rs. 37,96,407 |

| 20 | Nil | Rs. 37,96,407 | Rs. 2,88,526.92 | Rs. 40,84,934 |

| 21 | Nil | Rs. 40,84,934 | Rs. 3,10,455 | Rs. 43,95,389 |

The total maturity value of this investment made under Sukanya Samriddhi Yojana (SSY) will be Rs. 43,95,389.

* The above rates may vary depending on the changing interest rates, and we suggest you use the SSY calculator to get an estimate for your personal requirements.

What is Sukanya Samriddhi Yojana (SSY) Calculator?

The Sukanya Samriddhi Yojana (SSY) calculator is an easy way of calculating the total interest on the amount deposited. The Sukanya Samriddhi Yojana (SSY) calculator evaluates the interest accrued on the initial investment amount and subsequent contributions made yearly until maturity.

As per the estimated amount calculated by the Sukanya Samriddhi Yojana (SSY) calculator, the parent can plan to make informed decisions for the important events of their girl child. The SSY calculator is easily available online and handy to use.

You need to provide the following details on the asked places.

- Enter the initial deposit towards the SSY scheme

- How much yearly investment are you going to make under the Sukanya Samriddhi Yojana (SSY)

- Age of girl child when starting the SSY account

- Starting date of the Sukanya Samriddhi Yojana (SSY)

The SSY calculator applies the current interest rate and provides the total investment amount, interest amount and maturity value at the end of 21 years.

What are Sukanya Samriddhi Yojana (SSY) Withdrawal Rules?

After 21 years, on the Sukanya Samriddhi Yojana (SSY) maturity, the depositor or the account holder can withdraw the principal amount deposited along with interest on maturity. The following rules are applicable for Sukanya Samriddhi Yojana (SSY) account withdrawal:

- To withdraw the amount on Sukanya Samriddhi Yojana (SSY) maturity, the applicant must submit the following documents: An application form for the withdrawal, valid identity proof, address proof, and citizenship documents.

- To utilize the Sukanya Samriddhi Yojana (SSY) amount to fund the admission fee of the education institute, the girl child should complete 10th grade or 18 years (whichever is earlier). In such cases, the admission letter or fee receipt must be submitted. The parent can withdraw a maximum of 50% of the previous year’s available balance. The Sukanya Samriddhi Yojana (SSY) amount withdrawal is possible in one time lump-sum amount or max 5 instalments.

- Premature withdrawal under Sukanya Samriddhi Yojana (SSY) is allowed if the child turns 18 and gets married. The parent/ legitimate guardian needs to submit the application one month before or after 3 months of marriage, along with the age proof of the SSY account holder (girl child).

Sukanya Yojana Prematurity Rules

The Sukanya Samriddhi Yojana (SSY) account is liable to provide prematurity benefits under the conditions when

- The girl turns 18 and gets married.

- The girl child no longer remains an Indian citizen.

- Unfortunate demise of the girl child.

- If the SSY account has remained active for at least 5 years, further discontinuation is requested.

What are Sukanya Samriddhi Yojana (SSY) Tax Benefits?

Below are the tax benefits of the Sukanya Samriddhi Yojana (SSY):

- Tax exemption of up to Rs. 1.5 lakh during a financial year on the deposit made by the depositor under Section 80C of the Income Tax Act of 1961.

- Section 10 (10D) of the Income Tax Act, 1961, allows the tax exemption on the interest accumulated on the amount.

- The maturity amount and the amount received at the time of withdrawal are liable to provide tax benefits.

What is the Application Process of Sukanya Samriddhi Yojana (SSY)?

The following steps must be followed to open a Sukanya Samriddhi Yojana (SSY) account.

Step 1: Visit the nearest branch: The parent or guardian can directly visit the nearest public bank or post office branch to collect the Sukanya Samriddhi Yojana (SSY) application form.

Step 2: Submission of required documents: Duly fill out the Sukanya Yojana form with the necessary information and submit it to the authority along with the following documents

- Birth certificate of the girl child

- Address proof of the applicant's parent or legal guardian

- Photo ID of the applicant parent or legal guardian

- KYC documents like PAN or Voter ID

- Medical certificate in case of twin or multiple children born

- Any other document, as requested

Step 3: Deposit the amount: Pay the first deposit to activate the Sukanya Yojana account in any preferable mode in cash, cheque, online, or demand draft. The depositor can submit an amount from Rs. 250/- to Rs. 1.5 Lakh.

Step 4: Account activation: After successfully verifying the details provided, a Sukanya Samriddhi account will be activated in the name of the girl child. The depositor receives a passbook for this account to keep the record.

Look for the best life insurance policies offered by life insurance companies to secure your family.

Open a Sukanya Samriddhi Yojana (SSY) Account in a Post Office

The government allows the applicants to open a post office Sukanya Samriddhi Yojana (SSY) account for their child. To apply for a Sukanya Samriddhi Yojana (SSY) post office, the parent/guardian needs to follow the simple steps given below

- Visit the nearest post office branch and request a Sukanya Samriddhi Yojana (SSY) account opening form.

- Fill out the form with the required details. If you already have a savings account in the post office, mention your account number.

- Provide the name of the girl child in the ‘Name of Applicant’ section and select ‘Sukanya Samriddhi Yojana (SSY)’ as the chosen option.

- Specify the account type and account holder type, and provide the initial deposit amount you wish to start the Sukanya Samriddi account with (min. Rs. 250/-).

- Submit the necessary documents, including your ID proof, address proof, PAN card, birth certificate, and other necessary documents as required by the post office authority.

- Sign at the end of Page 1 to authorize all the information.

- Provide the nomination details in the nomination section. If the applicant needs to be literate, the signatures of two witnesses are required.

Open a Sukanya Samriddhi Account Through the Bank

To open a Sukanya Samriddhi account in the listed bank, the parent/ guardian can follow the given steps

Offline Process

- Visit the nearest bank branch in person and request the Sukanya Samriddhi Yojana (SSY) application form.

- Provide all the required details along with the documents for verification.

- Once the officials verify all the documents, they will approve the application.

- You will receive the confirmation details on your registered mobile number.

Online Process

- To complete the application process online, visit the official website and download the Sukanya Samriddhi Yojana (SSY) application form.

- Duly fill and submit the form along with the other required documents.

- You will receive a confirmation email or SMS.

Which Banks are Included in the Sukanya Samriddhi Yojana?

The parent or legal guardian can reach the following banks from the list below to open a Sukanya Samriddhi Yojana (SSY) account (SSY account).

| Allahabad Bank | Vijaya Bank |

| Andhra Bank | Oriental Bank of Commerce |

| Axis Bank | Punjab National Bank |

| Bank of India | Punjab & Sind Bank |

| Bank of Baroda | Syndicate Bank |

| Bank of Maharashtra | State Bank of India |

| Canara Bank | UCO Bank |

| Corporation Bank | United Bank of India |

| Central Bank of India | Union Bank of India |

| Dena Bank | ICICI Bank |

| Indian Overseas Bank | Indian Bank |

| IDBI Bank |

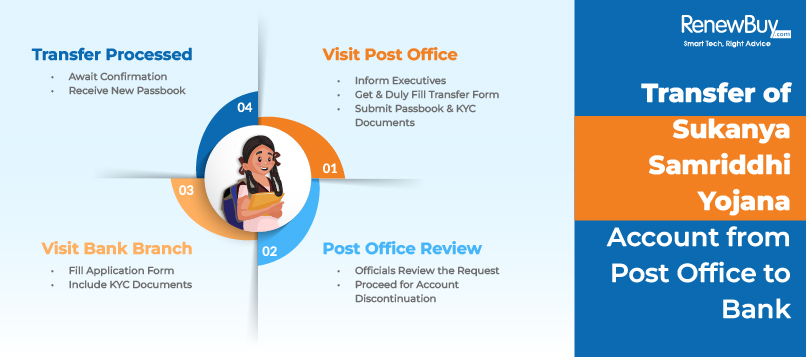

How to Transfer Sukanya Samriddhi Yojana (SSY) Account from the Post Office to the Bank?

In case you wish to transfer the Sukanya Samriddhi Yojana (SSY) post office (SSY) account from the to the listed bank, you can follow the given steps

- Visit the post office where your current Sukanya Samriddhi Yojana (SSY) post office account is active and inform the executives about the transfer.

- The officials provide the form for the transfer that you need to fill out and submit along with the passbook and KYC documents.

- The post office executive will review your request and discontinue the current SSY account.

- Next, visit the bank branch where you want to transfer and continue the Sukanya Samriddhi Yojana (SSY) account.

- Fill out the application form with the necessary documents, including self-attested KYC documents.

- Once the officials process the transfer request, you receive the confirmation request and a new passbook upon successful completion.

How to Pay Sukanya Samriddhi Yojana (SSY) Post Office Account Payment?

The Indian post office has digitized its services to improve customer experience. Now, you can make online payments to the Sukanya Samriddhi Yojana (SSY) post office account using the IPPB mobile application. Follow the given instructions for a successful Sukanya Samriddhi Yojana (SSY) post office payment.

- Download the IPPB mobile application on your mobile phone and log in to your IPPB account.

- Transfer the required sum from the bank to the IPPB account you wish to submit.

- Choose the ‘Sukanya Samriddhi Yojana (SSY)’ account under the DOP product option.

- Provide the customer ID and SSY account number.

- Next, the depositor should choose the amount to be deposited with the duration of instalments.

- The user is notified once the amount is transferred.

How to Check Sukanya Samriddhi Yojana (SSY) Account Balance?

Individuals can check their Sukanya Samriddhi Yojana (SSY) account balance and other details online and offline. Keep reading further to discuss the process.

Online Process to Check Sukanya Samriddhi Yojana (SSY) Account Balance

When you open a Sukanya Samriddhi Yojana (SSY) account with a bank, you receive an account number and login credentials to use and check the Sukanya Samriddhi Yojana (SSY) account balance online. Follow the below steps

- Open the Internet banking portal of the bank approved to log in to your SSY account.

- Enter your login credentials.

- Next, on the homepage, you can find the Sukanya Samriddhi Yojana (SSY) account balance and details.

Some banks do not provide the online portal option to check SSY account balance; in that case, one must opt for the offline method.

Offline Process to Check Sukanya Samriddhi Yojana (SSY) Account Balance

To check the Sukanya Samriddhi Yojana (SSY) balance offline, you must visit the dedicated post office or a bank branch where the SSY account is running. To know, you need to

- Update your passbook

- Collect your bank statement

If the distance is an issue for you, transfer your Sukanya Samriddhi Yojana (SSY) account to the nearest bank that is registered with RBI and approved for the SSY scheme.

Key Points to Remember about the Sukanya Samriddhi Yojana (SSY) Scheme

Before you open Sukanya Samriddhi Yojana (SSY) post office or bank account after calculating the interest rate with Sukanya Samriddhi Yojana (SSY) calculator, the following key points are important to consider.

- A minimum of Rs. 250 and a maximum of Rs. 1.5 Lakh of deposit is allowed in a year. If the parent deposits below the minimum amount, the account will be considered default.

- The ‘Account Under Default’ is eligible for the interest until maturity, but a penalty of Rs. 50 per year is applied to regularise the account within 15 years of opening.

- Deposits exceeding Rs. 1.5 Lakh does not qualify to earn interest, but the depositor can withdraw the amount anytime during the year.

- The deposits are required for the first 15 years; later, the deposits are voluntary. However, the Sukanya Samriddhi Yojana (SSY) account continues to earn interest until maturity, even if no deposits are made.

- The interest stops once the account completes 21 years (maturity period) from the account opening date.

What is the Difference Between PPF and Sukanya Samriddhi Yojana (SSY)?

Planning your investment is the most important decision you can make. Before committing to a long-term investment under a life insurance plan, term insurance plan, or child plan, you must compare and understand the different options available.

In case of investment made under the child plan, like Sukanya Samriddhi Yojana (SSY) or, PPF or any ULIP plan available, it is important to understand the working process. The PPF is also a government-initiated scheme but more of a retirement plan, whereas Sukanya Samriddhi Yojana (SSY) is a small savings scheme aiming at the welfare of a girl child. Let us analyse the differences and benefits for a better understanding.

| Parameters | Public Provident Fund | Sukanya Samriddhi Yojana (SSY) |

|---|---|---|

| Rate of Interest | 7.1% compounded yearly | 8.0% compounded yearly |

| Eligibility | Any Indian resident | Girl child below 10 |

| Annual Deposit | Min: Rs. 500/- Max: Rs. 1.5 Lakh | Min: Rs. 250/- Max: Rs. 1.5 Lakh |

| Tax Benefit | Upto Rs. 1.5 Lakh | Upto Rs. 1.5 Lakh |

| Policy Term | 15 years | 21 years |

| Partial Withdrawal | After 15 years | Upon the child completing 18 years and getting married or higher education |

| Loan Availability | Yes | No |

| Nomination | Required | Required |

What is the Difference Between Child Mutual Fund and Sukanya Samriddhi Yojana (SSY)?

Child plans are the best way to secure your child’s future and give them financial freedom to accomplish their dreams. You may find it confusing when deciding between a child mutual fund and the Sukanya Samriddhi Scheme to invest in. Let’s discuss the key differences and clear your doubts.

| Parameters | Child Mutual Fund | Sukanya Samriddhi Yojana (SSY) |

|---|---|---|

| Eligibility | Child under 18 years | Girl child below 10 years |

| Account Opening | Parent or guardian | By parent or legal guardian |

| Account Per Family | No restriction | Max 2 accounts Max 3, in case of twins/ triplet girl child |

| Lock-in Period | 5 years | 18 years |

| Return on Investment | Depends upon the market performance of the funds | Fixed by the government and reviewed quarterly |

| Risk | Higher | No risk |

Sukanya Samriddhi Yojana (SSY) is one of the best investment options to earn guaranteed benefits and secure the future of your girl child. While the Sukanya Samriddhi Yojana (SSY) scheme is specially designed for the girl child, you can invest in a Child Mutual Fund without gender restrictions and earn higher returns. Experts suggest investing in both plans to earn maximum benefits.

*Want to secure the future of your family when you no longer will be receiving monthly income? Learn more about the profitable options available.

Final Words

The main objective of Sukanya Yojana is to make Indian girls financially independent. A parent can invest a part of their income for upto 21 years and earn compounding benefits.

Other than that, many child plans, term plans, and ULIP plans are available to start investment and make your child’s future a no-stress job. If you want to earn risk-free high returns in small savings, then the SSY scheme is the best investment plan.

Want more detailed information on Sukanya Samriddhi Yojana (SSY) or other child plan options available to invest and secure your child’s future? Quickly connect with one of our partners and buy a suitable plan for your girl child in minutes.

*Learn about how you can become an insurance agent in India.

Related Article

Top 10 Life Insurance.....

IRR In Insurance

Surrender Value in.....

Viklang Pension Yojana: Eligibility,.....

How to Check Ladli.....

How to Check Chief.....

Top 10 Pension.....

Government Life Insurance Schemes.....