Term Insurance

Are you the sole breadwinner of your family? Think about your family in case something unexpected happens to you. What will be their education and future? How will your family run in your absence? A term insurance plan is a solution to this situation! Buying a term insurance plan for those with financial dependents is advisable. This includes married couples, businessmen, parents, SIP investors, etc.

What is Term Insurance?

Term insurance is a type of life insurance in which the life insurance company provides a predetermined amount to the beneficiary in case of an unexpected death of the policyholder. Term insurance is also known as a "pure protection plan". It offers a budget-friendly plan that offers more coverage at an affordable premium.

For example, a healthy, non-smoker 24-year-old male can get INR 1 crore cover for his dependents for the next 25 years. If he buys a term insurance plan, he can get term insurance of 1 Crore for less than INR 600. This shows that it is the most economical option as compared to other life insurance plans.

Who Should buy Term Insurance?

Term insurance is a type of life insurance policy that protects you and your loved ones from financial constraints caused by unforeseen events like disability, diseases, and death. Anyone with financial responsibilities or dependents should always buy an online term insurance plan.

Newly Married

A term insurance policy can be very beneficial for a newly married couple as it provides a financial safety net for your spouse in case of your unfortunate demise. Term life insurance not only secures the future of your family but also takes care of the liabilities.

Young professionals

Term life insurance provides adequate coverage amount at a low premium amount. The reason for this is very simple, and young professionals do not have financial liabilities, so buying a term insurance plan can be very beneficial for young professionals.

Parents

In most families, parents are the only source of income and the only financial support for their children. Having a term life insurance policy is the best option to secure the financial future of the children. In case of unfortunate death of the policyholder, the term insurance company provides a lump sum amount as a death benefit to the beneficiary.

Tax Payers

One of the best benefits of having a term insurance plan is the tax benefit. As per Section 80C of the Income Tax Act, the premium paid for a term policy is tax-exempt. So, if you want to save on tax, you should consider buying a term insurance plan.

Self-Employed

There are several difficulties you face as a self-employed person. You don’t have a fixed monthly income, your income fluctuates according to the ups and downs of the market. Therefore, purchasing a term insurance plan to protect your family becomes even more crucial.

Retired People

A term insurance policy can be very beneficial for retired persons if they have dependent spouses and family. Term life insurance provides financial security to the dependents in case of the sudden demise of the assured person.

When Should Buy Term Insurance?

It is better to buy a term insurance plan as early as possible as you can save more on it. The premium amount of term insurance increases with age, which means that if you have bought term insurance in the early days of your life, you will have to pay a lower premium amount than when you bought it at a later stage of life. The table below shows the comparison between the premium amount for a young and healthy person and a middle-aged person for the policy tenure of 15 years with a monthly payment mode and life cover of INR 1cr.

Health Male

| Age | 25 years |

| Policy Tenure | 15 Years |

| Sum Assured | 1 Crore |

| Premium Amount | INR 499 approx |

Healthy Middle-aged Male

| Age | 35 years |

| Policy Tenure | 15 Years |

| Sum Assured | 1 Crore |

| Premium Amount | INR 705 approx |

Eligibility Criteria for Term Insurance

It is always advisable to check the eligibility criteria for term life insurance plan before buying it. Below mentioned are the eligibility criteria to buy the term insurance plans are:

| Specifications | Eligibility Criteria |

|---|---|

| Minimum age | 18 Years |

| Maximum age | 65 Years |

| Minimum Policy Term | 5 years (may vary from insurer to insurer) |

| Maximum Policy Term | No Limit (may vary from insurer to insurer) |

| Who Should Buy? | Parents, Senior Citizens, Newly Married Couple, Young Professionals |

| Are NRIs Eligible for Term Plan | Yes |

| Payout Options |

|

| Add-on Riders |

|

| Required Documents |

|

| Pre-medical Screening Test | Yes, it is mandatory to undergo a medical test before buying a term insurance policy. |

Types of Term Insurance

There are various term life insurance companies offer different term plans in India. Each term plan has its own set of features. Let’s discuss these different types of term insurance plans in detail:

Level Term Plan

It is the easiest and most basic term life insurance plan. Level Term Plan provides a fixed sum amount to the beneficiary in case of the policyholder's demise. In the level term plan, Both the premium and death benefit are fixed throughout the policy tenure.

Term Return of Premium Plan (TROP)

Term return of premium plan is a type of term insurance plan in which the life insurance company returns the premium paid for the cover in case the insured survives the policy tenure. These policies are gaining popularity as the policyholder will get back the money he has invested for the term insurance cover.

Increasing Term Insurance Plan

In increasing term insurance, the policyholder can increase the sum assured amount annually during the policy tenure. The increasing term insurance plan provides coverage for the risk of rising inflation costs in the country.

Decreasing Term Insurance Plan

Decreasing term plan is a type of term insurance plan in which the Sum Assured reduces every year at a pre-specified percentage. This type of plan is usually issued by the bank to recover the loan and pay all the debt.

Convertible Term Plan

Convertible term insurance plan is a type of term insurance plan which can be converted to another type of term plan at later stages of the policy. For example: If you buy a term life insurance plan for 25 years, then after 5 years you can convert it to any other type of term insurance plan like an endowment term plan, level term plan, etc.

How Does a Term Insurance Plan to Secure Your Family’s Future?

A term insurance plan is a type of life insurance policy that provides coverage for a specified term or period. It offers financial protection to your family in case of your untimely demise during the policy term. Here's how a term insurance plan can help secure your family's future:

Death Benefit

The primary objective of a term insurance plan is to provide death benefits to your beneficiaries if you pass away during the policy term. This lump sum amount can help your family cover various financial obligations such as daily living expenses, outstanding loans, mortgage or rent payments, education expenses and other financial goals.

Income Replacement

Losing a family member often means loss of income. Term insurance plans can replace the lost income by providing good payouts to your dependents. This ensures that your loved ones can maintain your standard of living and meet their financial needs even in your absence.

Debt Repayment

If you have outstanding loans like home loans, car loans, or personal loans, they can become a burden on your family if you are no longer there to repay them. The death benefit from a term insurance plan can be used to settle these loans, thereby preventing your loved ones from shouldering financial responsibility.

Education Expenses

If you have children or dependents who are pursuing higher education, a term insurance plan can ensure that their educational aspirations are not compromised. The payment can be used to meet their tuition fees, college expenses and other educational needs to help them achieve their goals.

Funeral and Final Expenses

Funeral and related expenses can be costly. A term insurance plan can provide the necessary funds to cover these immediate expenses, saving your family from additional financial burdens during these difficult times.

Business Continuity

If you are a business owner, a term insurance plan can help ensure smooth business continuity in case of your untimely death. Payments can be used to pay off business debts, buy out a deceased partner's share, or provide capital for company operations, safeguarding the financial stability of your business.

Estate Planning

A term insurance plan can also play an important role in estate planning. This can help cover estate taxes and other legal expenses, ensuring your assets are protected and transferred to your heirs without significant financial strain.

Best Term Insurance Plans in India

Many term life insurance companies are providing various term insurance plans in India. Hence, finding the best term insurance plan is a very difficult task to do. To make it easier for you, we “RenewBuy” have created a list of the best term insurance plans in India. Below mentioned is the list of best term plans along with their key features, claim settlement ratio, maximum maturity age, and premium amount.

| Term Life Insurance Company | Term Insurance Plan | Key Features | Premium Amount (for 1cr sum assured/ policy term: 25 years/ age: 25 years ) |

|---|---|---|---|

| ICICI Prudential Term Insurance | ICICI iProtect Smart |

|

INR 806 |

| HDFC Term Life Insurance | HDFC Click 2 Protect Life |

|

INR 843 |

| Max Term Life Insurance | Smart Secure Plus Plan |

|

INR 800 |

| TATA AIA Term Insurance | TATA AIA Sampoorna Raksha Supreme |

|

INR 600 |

| PNB Metlife India Insurance | Mera Term Plan Plus |

|

INR 722 |

*Disclaimer: We RenewBuy does not endorse any specific insurance company or insurance product offered by any insurer and this list is just an illustration of the plan offered by different life insurance companies.

Life Insurance Companies Offering Term Insurance Plans in India

Below mentioned is the list of life insurance companies offering term insurance plans along with its claim settlement ratio.

| S.No. | Life Insurance Company | Individual Death Claim Settlement Ratio (CSR) 2021-22 |

|---|---|---|

| 1. | Aditya Birla Sun Life Insurance | 98.07% |

| 2. | Aegon Life Insurance | 99.03% |

| 3. | Ageas Federal Life Insurance | 97.03% |

| 4. | Aviva Life Insurance | 98.39% |

| 5. | Bajaj Allianz Life Insurance | 99.02% |

| 6. | Bharti AXA Life Insurance | 99.09% |

| 7. | Canara HSBC OBC Life Insurance | 98.44% |

| 8. | Edelweiss Tokio Life Insurance | 98.09% |

| 9. | Exide Life Insurance | 99.09% |

| 10. | Future Generali Life Insurance | 96.15% |

| 11. | HDFC Life Insurance | 98.66% |

| 12. | ICICI Prudential Life Insurance | 97.82% |

| 13. | IndiaFirst Life Insurance | 96.92% |

| 14. | Kotak Mahindra Life Insurance | 98.82% |

| 15. | Axis Max Life Insurance | 99.65% |

| 16. | PNB MetLife India Insurance | 97.33% |

| 17. | Pramerica Life Insurance | 98.30% |

| 18. | Reliance Nippon Life Insurance | 98.67% |

| 19. | Sahara India Life Insurance | 97.08% |

| 20. | SBI Life Insurance | 97.05% |

| 21. | Shriram Life Insurance | 82.39% |

| 22. | Star Union Dai-ichi Life Insurance | 97.42% |

| 23. | Tata AIA Life Insurance | 98.53% |

| 24. | Life Insurance Corporation of India | 98.74% |

*Data has been sourced from IRDAI Annual Report FY 2021-22

| S.No. | Life Insurance Company | Group Death Claim Settlement Ratio (CSR) 2021-22 |

|---|---|---|

| 1. | Aditya Birla Sun Life Insurance | 99.59% |

| 2. | Aegon Life Insurance | 100% |

| 3. | Ageas Federal Life Insurance | 89.92% |

| 4. | Aviva Life Insurance | 99.85% |

| 5. | Bajaj Allianz Life Insurance | 99.82% |

| 6. | Bharti AXA Life Insurance | 97.96% |

| 7. | Canara HSBC OBC Life Insurance | 99.18% |

| 8. | Edelweiss Tokio Life Insurance | 99.39% |

| 9. | Exide Life Insurance | 100% |

| 10. | Future Generali Life Insurance | 95.63% |

| 11. | HDFC Life Insurance | 99.72% |

| 12. | ICICI Prudential Life Insurance | 97.74% |

| 13. | IndiaFirst Life Insurance | 99.18% |

| 14. | Kotak Mahindra Life Insurance | 99.59% |

| 15. | Axis Max Life Insurance | 99.41% |

| 16. | PNB MetLife India Insurance | 99.53% |

| 17. | Pramerica Life Insurance | 98.42% |

| 18. | Reliance Nippon Life Insurance | 99.49% |

| 19. | Sahara India Life Insurance | 0 |

| 20. | SBI Life Insurance | 97.33% |

| 21. | Shriram Life Insurance | 99.56% |

| 22. | Star Union Dai-ichi Life Insurance | 98.23% |

| 23. | Tata AIA Life Insurance | 99.43% |

| 24. | Life Insurance Corporation of India | 97.08% |

*Data has been sourced from IRDAI Annual Report FY 2021-22

Key Features of Term Life Insurance Plans

Below mentioned are the key features of the Term Life Insurance Plans:

| Particulars | Description |

|---|---|

| Affordable | Term insurance provides higher coverage amount at an affordable premium amount |

| Entry Age | 18 Years |

| Buying Mode | Online and Offline |

| Premium Payment Options | Monthly, Quarterly, Annually |

| Add-on Riders | Available |

| Claim Assistance | Available |

| Premium Payment Frequency | Monthly, Quarterly, Half-Yearly, Annually, Single |

| Minimum Sum Assured | 5 Lakhs (may vary from insurer to insurer) |

| Maximum Sum Assured | No Limit (may vary from insurer to insurer) |

| Death Benefits | Available |

| Maturity Benefits | Available (TROP) (may vary from insurer to insurer) |

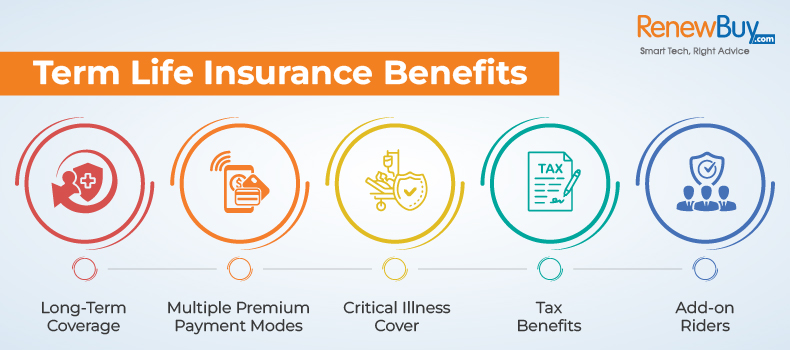

Term Life Insurance Benefits

Term insurance plan is a must for everyone and we cannot ignore its importance in today's life. Our primary goal is financial security and the happiness of the family, and term insurance fulfils this. Now that everyone is aware of its importance in life, here are some other major benefits of term insurance plans in India.

Long-Term Coverage

Term insurance provides coverage to the policyholder for its entire life.

Multiple Premium Payment Modes

Term Life Insurance offers various premium payment modes such as regular, single, and limited pay.

Critical Illness Cover

Term insurance offers protection against critical illness. A term life insurance plan provides a lump sum amount in case of the policyholder suffers from any critical illness for the first time.

Tax Benefits

As per Section 80C of the Income Tax Act (ITA), 1961, you are eligible for tax deduction for term plan premium up to Rs 1.5 lakh. Additionally, the term plan also helps you save up to INR 46,800 if you fall under the 30% tax bracket. As per Section 10(10D) of the Income Tax Act, your beneficiary's death benefits are also tax-free.

Add-on Riders

You can enhance your basic term insurance coverage benefits by choosing optional add-on riders who pay a certain premium. Some of the common add-on riders include accidental disability riders, accidental death benefits, waiver of premium, etc.

Term Life Insurance Riders

There are various types of add-on riders offered under term life insurance plans. You can choose add-on riders to enhance your coverage benefits of a term life insurance plan by paying some additional premium amount. Knowing the various add-on riders is important to choosing the best additional riders. Below mentioned is the list of common optional add-on riders offered by every term life insurance company:

| Rider Name | Description |

|---|---|

| Accidental Death Rider | In case of death of the policyholder due to an accident, the insurance pays a lump amount to the beneficiary |

| Critical Illness Cover | The term insurance company pays a lump sum amount to the beneficiary if the policyholder is diagnosed with any of the listed critical illness |

| Accidental Disability Rider | In case of the permanent disability of the policyholder due to an accident, the insurance pays a lump amount to the beneficiary |

| Terminal Illness Rider | The term insurance company pays a lump sum amount to the beneficiary if the policyholder is diagnosed with an incurable disease illness |

| Premium Waiver Rider | The term insurance company waive off all the future premium if the policyholder is unable to pay premiums because of permanent disability or death. |

Why Buy Term Insurance Plan Online?

You can buy your term insurance plan online as well as offline. But, the online mode offers you many other benefits besides the simple and hassle-free shopping process. Below mentioned are the various other benefits available in online mode.

Comparison

You can compare different term life insurance plans simultaneously. It is essential to compare different term plans before buying a term insurance plan for yourself as it helps you find the most suitable term insurance plan as per your requirement.

Reliability

Online platform is a bit more reliable as it provides transparency in the buying process. In online mode, everything is in front of the customer such as policy features, policy terms and conditions, etc. Apart from this, it also helps you make an informed decision as you can also check the customer reviews of the policy.

Safety and Security

The online platform provides a safe and secure environment for customers to make online payments through its secure gateways.

Customization

The online platform allows you to customize your term plan as per your requirements. You can also add additional riders to enhance the coverage benefits of the term plan.

Time-Saving

Buying a term insurance plan online helps you to save time as you can get term insurance premium quotes in just a few clicks.

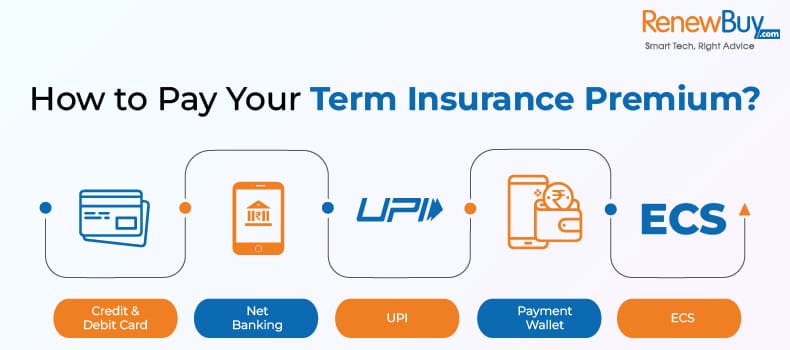

Various Premium Payment Options

Online mode offers various premium payment options in a secure environment. You can make your payments through online mode safely and quickly. You can use various payment options like Debit/Credit Card, UPI, Net Banking, etc.

Term Insurance Premium Calculator

Term Insurance Premium Calculator is an online tool specially designed to calculate the estimated premium amount that you need to pay for your desired term life insurance plan. Term Life Insurance Calculator is a simple and easy-to-use online tool that helps you make an informed decision as you can compare different term insurance policies at a time. If you are looking to buy a term insurance plan, it is advisable to use a term insurance calculator. Some of the significant benefits of using a term premium calculator are mentioned below:

- Time Saving

- 24x7 Availability

- Easy Comparison

- Convenient

- Discounted Premiums

Factors Affecting Term Life Insurance Premium

Below mentioned are the factors that can affect your Term insurance premium amount:

Age

Term insurance companies offered a lower premium to younger individuals as compared to older persons because older persons are more likely to claim earlier.

Gender

Life insurance companies offer lower premiums to women than men because many studies have stated that women live longer than men.

Family History

The insurance companies offer a higher premium amount to those individuals who have a family history of diseases such as cardiovascular diseases, cancer, etc.

Smoking Habits

The term insurance company offers a higher premium amount to smokers as compared to non-smokers.

Policy Duration

You will pay more premiums if the policy term is longer as the insurer will have to cover your life at a higher risk.

Occupation

People who work in industries like transportation, shipping, gas, oil mining etc., are more likely to be in accidents. Therefore, the premium rates will be higher in these situations than for a desk job.

Term Insurance Premium Payment Option

Term insurance offers different premium payment options such as single pay, regular pay, and limited pay. You can decide your premium payment option per the requirement and future goals.

Regular Pay

In this payment option, you must pay premiums periodically for the complete policy duration. You can select monthly, half-yearly, and annually options to pay premiums.

Limited Pay

In this option, the premium payment term is less than the policy term.

Single Pay

In this premium payment option, you must pay the entire premium amount once while buying the policy.

How to Calculate Term Insurance Premium?

You can calculate term insurance policy premiums with the help of a term life insurance premium calculator. You just have to enter some information like name, mobile number, medical history, date of birth, phone number, annual income, etc. Based on this information, you will be able to check the estimated term insurance premium that you will have to pay for your term life insurance plan. Below mentioned are the steps to calculate your term insurance premium amount:

- Visit the official website of the “RenewBuy”.

- Click on the “Life Insurance” tab.

- Enter the required information such as full name, gender, mobile number, Email ID, occupation, and annual income.

- Click on the “Get Started” tab.

- Enter the other required information

- The next tab will show you the estimated premium of the term insurance plans.

Why Choose Term Insurance From RenewBuy?

RenewBuy brings you the best deals in term insurance plans across the market. The key reasons for you to consider us are as follows:

- IRDAI Certified

- Get Insured from leading Insurer

- Discounted Premiums

- Compare Various Term Plans in Just a few Clicks

- Simple & Easy Buying Process

- 24x7 Claim Assistance

Can NRIs be able to Buy Term Insurance Plans in India?

Non-Resident Indians (NRIs) are generally eligible to buy term insurance plans in India. Many life insurance companies in India offer term insurance policies specially designed for NRIs. Here are some key points to consider:

-

Documentation

As an NRI, you must provide specific documents while buying a term insurance plan in India. This usually includes proof of identity, proof of address, proof of income and relevant visa or residence documents.

-

Policy Application

NRIs can apply for term insurance plans online or through the Partners of the RenewBuy company. Online applications have made it more convenient for NRIs to buy insurance policies from abroad.

-

Medical Requirements

Life insurance companies may require NRIs to undergo medical tests or provide medical reports to assess their health status. These requirements may vary depending on the sum assured and the age of the life assured.

-

Premium Payment

NRIs can pay premiums for their term insurance plans through various channels, including online payment gateways, NRE/NRO bank accounts, or international wire transfers. Insurance companies generally accept premium payments in Indian Rupees.

-

Claim Settlement

In case of a claim, the nominee or beneficiary can usually receive the claim settlement amount in India. When purchasing the policy, it is advisable to have clear instructions regarding the settlement process and nominee details.

Term Insurance Plan Buying Process

You can buy a term insurance policy from the insurance company’s official website as well as from “RenewBuy”. Below mentioned are both the buying process of term insurance plans:

Buy from the official website of the insurance company

- Visit the insurance company’s official website and click on the “Term Insurance” tab.

- Select the desired plan.

- Fill in all the required information such as name, mobile number, annual income, occupation, etc.

- Click on the “Buy Now” button.

- Make payment.

- The insurance company will send the policy documents to your email address.

Buy from “RenewBuy”

- Visit the official website of RenewBuy.

- Click on the “Life Insurance” tab.

- Fill out the form that shows on the next page.

- Compare term insurance plans and select your desired plan.

- Click on the “Buy Now” button

- A pop-up will show you the plan details and the additional riders information.

- Click on the “Proceed to Buy” button.

- Make online payment and the policy documents will be sent to your registered email address.

Documents Required To Buy Term Life Insurance Plan

Below mentioned are the documents required for a Term Life insurance plan in India:

- Identity Proof such as an aadhar card

- Age Proof

- Address Proof

- Medical Report

- Salary reports

- Passport size photos

- Form 16 for salaried employees

- Form 16A for self-employed

Term Insurance Claim Process

Mostly term life insurance companies offers easy and quick claim process. Below mentioned are the steps to file a claim for your term life insurance plan:

- Inform the insurance company

- Submit the required documents for verification

- Insurance company will verify the submitted documents

- Insurance company will provide you with the approval

- Then, the insurance company will settle your claim within 15 to 30 days

Required Documents for Claim Settlement

Below mentioned are the documents that a nominee need to submit while filing a term insurance claim:

In case of Natural Death

- Original Policy Document

- Claim Form

- Application from claimant

- Other Required Documents

- Hospital Discharge Summary (in case of death due to illness)

- Medical report (in case of death due to illness)

In case of Accidental Death

- Post Morterm Report

- FIR Report

- Original Policy Document

- Claim Form

- Certificate of medical attendance

- Statement of attending doctor

- Other Required Documents

Term Insurance Jargons

These are some of the common terms used in term insurance. It is essential to familiarize yourself with these terms and carefully understand the details of your specific policy before making a purchase decision. Here are some standard terms associated with term insurance:

Death Benefit

It is a type of benefit in which the sum assured amount will be given to the nominee in case of the policyholder's demise.

Sum Assured

Sum Assured is a predetermined amount that the life insurance company will pay the nominee or beneficiary on the death of the life assured during the policy term.

Term Insurance Premium

Term insurance premium is the amount that policyholders pay the life insurance company at regular intervals (monthly, quarterly, annually) to maintain the policy coverage. This may vary depending on factors such as age, health, and sum assured.

Policyholder

The policyholder is the individual who owns the term insurance policy and pays the premiums to the insurance company.

Insured Person

An insured person is a person whose life is covered by a term insurance policy. The death benefit is paid to the nominee or beneficiary in case of their death during the policy term.

Nominee/Beneficiary

The nominee or beneficiary is the person who the policyholder nominates to receive the death benefit in case the life insured dies during the policy term. The nominee/Beneficiary is required to be mentioned at the time of purchasing the policy.

Add-on Riders

Additional benefits or optional features can be added to the term insurance policy for an additional premium. Some common add-on riders include an accidental death benefit, critical illness rider, waiver of premium and disability benefit.

Surrender Value

Surrender value is the money the policyholder may receive if they terminate the policy before maturity. Term insurance policies generally do not have surrender value as they are pure protection plans.

Free Look Period

The free look period is a specified period after purchasing the policy, during which the policyholder can review the terms and conditions. If dissatisfied, they can return the policy for cancellation subject to the terms and conditions and get a refund of the premium paid.