Senior Citizen Health Insurance

In today's era, people are not safe regarding their health due to a sedentary lifestyle. The food we eat and the air we breathe are not pure at all. It is very harmful to our health, especially for older people. As people age, certain diseases become more likely and more severe. As a result, senior citizens face higher healthcare costs. However, many older people do not have any permanent source of income apart from their pension. Due to their limited resources, they may need more money to pay for expensive medical treatment. As a result, it is essential to have senior citizen health insurance.

What is Senior Citizen Health Insurance?

Senior citizen health insurance is a comprehensive policy that covers individuals above 60 years of age. It's designed to alleviate the financial and physical stress of senior citizens in case of illness or hospitalization. Senior citizen health insurance provides extensive financial assistance for medical treatment and can be purchased as an individual or family floater. Policyholders can also enjoy a range of benefits, including coverage for in-patient hospitalization, no pre-screening, and pre and post-hospitalization, ensuring they are well-informed and aware of the value they can receive.

Senior Citizen Health Insurance Specifications

Senior citizen health insurance is a type of health insurance plan that allows you to relax and enjoy your second inning. The following are the specifications and requirements:

| Categories | Specifications |

|---|---|

| Minimum Entry Age | 60 years and above |

| Maximum Entry Age | No age limit |

| Cashless Hospitalization | At network hospitals |

| Annual Health Check-ups | Available |

| Renewability | Lifelong Renewwability |

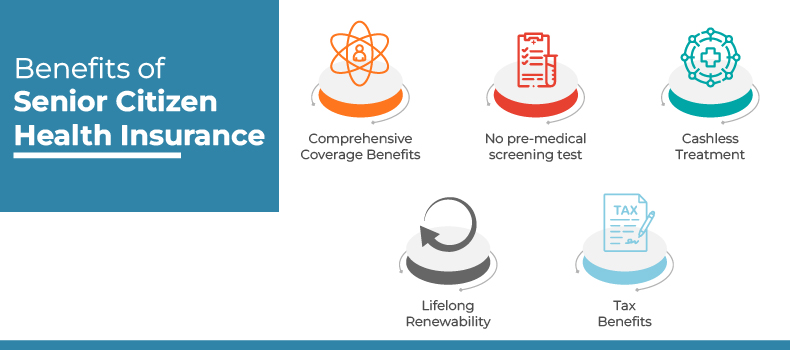

Benefits of Health Insurance for Senior Citizen

Health Insurance for senior citizens provides several benefits to elderly people. The following are some of the primary benefits offered under the senior citizen mediclaim policy:

Comprehensive Coverage Benefits

The Senior Citizen Health Policy provides comprehensive protection to elderly people. It also helps them get advanced medical treatment without worrying about their finances.

No pre-medical screening test

Most health insurance companies in India do not require a pre-medical exam for these senior citizen plans. However, people over 60 who can choose a standard health insurance plan will certainly have to undergo a pre-medical screening test. This is one of the most important benefits, as most people in their 60s suffer from pre-existing diseases and are hence unable to buy a standard health insurance plan from any health insurance company.

Cashless Treatment

Senior citizens can avail themselves of cashless treatment in health insurance companies' network hospitals. Every health insurance company offers cashless treatment under their senior citizen health insurance plans

Lifelong Renewability

Most health insurance for senior citizens offers lifetime renewal benefits. This means you can get health coverage for a lifetime without any age limit or restrictions.

Tax Benefits

Under Section 80D of the Income Tax Act, 1961, premiums paid under senior citizen health plans are eligible for tax benefits up to INR 50K. An annual rebate of INR 5K is also available for preventive health check-ups.

Best Health Insurance for Senior Citizens in India

Finding the best health insurance for senior citizens can be a very stressful task for any individual, as many senior citizen health insurance plans are available from various health insurance companies in the market. To make it easier for you, RenewBuy has compiled the list of best senior citizen health insurance plans in India along with its key features in the table below:

|

Niva Bupa Health Insurance |

Plan Coverage Benefits

- Daycare Treatment

- AYUSH Treatment

- Organ Donor

- Annual Health Checkups

- Emergency Ambulance

Senior Citizen Health

Insurance Plans

Senior first

|

Care Health Insurance |

Plan Coverage Benefits

- No pre-policy medical checkups

- Ambulance expenses

- Domiciliary expenses

- Organ donor expenses

Senior Citizen Health

Insurance Plans

Care Senior

|

Aditya Birla Health Insurance |

Plan Coverage Benefits

- Daycare expenses

- Ambulance expenses

- Health check-up

- ICU Expenses

Senior Citizen Health

Insurance Plans

Activ Care

|

HDFC Ergo Health insurance |

Plan Coverage Benefits

- Mental Healthcare

- Home Hospitalization

- Organ Expense

- Daycare treatments

Senior Citizen Health

Insurance Plans

My Health Suraksha

|

HDFC Ergo Health Insurance |

Plan Coverage Benefits

- Daily Hospital Cash

- All Daycare Expenses

- Emergency Air Ambulance

- Domiciliary hospitalization

Senior Citizen Health

Insurance Plans

Optima Secure

|

Star Senior Citizen Red Carpet Plan |

Plan Coverage Benefits

- Cataract Treatment

- Daycare Treatment

- Lifelong Renewability

Senior Citizen Health

Insurance Plans

Entry Age: 65 Years to 75 Years

Sum Insured: 1 Lakhs to 25 Lakhs

|

Care Senior Citizen Plan |

Plan Coverage Benefits

- Ambulance Cover

- Organ Donor

- Domiciliary hospitalization

Senior Citizen Health

Insurance Plans

Entry Age: 61 Years to No Upper Limit

Sum Insured: 3 Lakhs to 10 Lakhs

|

ManipalCigna Prime Senior |

Plan Coverage Benefits

- Domiciliary Hospitalization

- Daycare Treatment

- Road Ambulance

Senior Citizen Health

Insurance Plans

Entry Age: 91 Days to No Upper Limit

Sum Insured: 3 Lakhs to 50 Lakhs

|

ICICI Health Booster |

Plan Coverage Benefits

- Donor Expense

- Daycare Treatment

- Domiciliary hospitalization

Senior Citizen Health

Insurance Plans

Entry Age: 91 Days to No Upper Limit

Sum Insured: Up to 10 Lakhs

|

Aditya Birla Activ Care Classic |

Plan Coverage Benefits

- ICU Expenses

- AYUSH Benefits

- Domiciliary hospitalization

Senior Citizen Health

Insurance Plans

Entry Age: 55 Years to 80 Years

Sum Insured: 3 Lakhs to 25 Lakhs

*Disclaimer: We RenewBuy does not endorse any specific insurance company or insurance product offered by any insurer and this list is just an illustration of the plan offered by different health insurance companies

Why Do You Need Senior Citizen Health Insurance?

Health insurance for senior citizens can be very beneficial for managing your financial impacts during hospitalization. If they have limited or no income, hospitalization can be mentally and financially challenging for them and their families. Therefore, investing in senior citizen health insurance is a good decision if you want to spend your money wisely. Some other primary reasons why you need senior citizen health insurance for your parents are:

Health insurance for parents can be very beneficial for managing your financial implications at the time of hospitalization. Hence, investing in senior citizen health insurance is a good decision if you want to spend your money wisely. Some other primary reasons why you need senior citizen health insurance for your parents are:

Rising Medical Treatment Cost

Medical costs have increased drastically in recent years, and are expected to rise even more. To meet these rising costs, it is necessary to have medical insurance. Also, having senior citizen health insurance will ensure that senior citizens get proper health facilities

Free of Cost Annual Health Checkups

Senior citizens require regular health check-ups, which can be very costly. Therefore, some senior citizen health policies provide annual check-up facilities that help reduce costs. You can read your policy document to know whether your policy covers these expenses

Coverage for Critical illness

Older people are more vulnerable to diseases like heart diseases, cancer, and some other chronic diseases. With a senior citizen insurance plan, you can buy a critical illness cover for those above 60 years of age

Peace of Mind

Elderly people may find it difficult to pay the hefty hospital expenses. As a result, senior citizen health insurance becomes necessary to cover the rising costs of minor and major illnesses of senior citizens of the family

Quick Links

What is Covered Under Senior Citizen Health Insurance?

Senior citizen health insurance is specifically designed to cater to the healthcare needs of elderly individuals. The coverage provided under senior citizen health insurance may vary between insurance providers and specific policy offerings. However, some of the common coverage benefits offered under senior citizen health insurance:

Hospitalization

A senior citizen health insurance plan covers all hospitalization expenses arising from diseases and injuries, such as doctor fees, room charges, medicine and drug costs, nursing fees, surgical appliances, ICU charges, and operation theatre charges.

Pre-Hospitalization

Medical expenses incurred before the policyholder's hospitalization are covered under Senior Citizen Health Insurance.

Post-Hospitalization

Medical expenses incurred after the discharge from the hospital are covered under Senior Citizen Health Insurance.

Daycare Treatment

Senior Citizen health insurance plans offer coverage for treatments that can be treated in less than 24 hours of hospitalization.

Domiciliary hospitalization

Health insurance plans for senior citizens cover expenses incurred due to home hospitalization due to the non-availability of hospital medical facilities.

AYUSH Treatment

Senior citizen health plans cover various alternative treatments such as Ayurveda, Yoga & Naturopathy, Unani, Siddha, and Homeopathy.

Hospital Daily Cash

Policyholders will get some cash amount each day during the time of hospitalization.

OPD Charges

The senior citizen health insurance plan covers the doctor’s prescription and medical test costs.

Annual Health Check-up

Senior citizen health plans offer free annual health checkups to policyholders.

Emergency Ambulance

Senior citizen mediclaim policy covers ambulance service charges in case of a medical emergency.

Room Rent

Room rent charges are covered under senior citizen health insurance. It is the maximum room charge that you can claim under the plan if you are hospitalized.

ICU charges

Senior Citizen Health Plan covers expenses related to the policyholder's admission to the Intensive Care Unit (ICU). The ICU is a special hospital department where patients with serious medical conditions are treated.

Automatic Restoration of SI

Automatic restoration of the sum insured is a benefit in which a health insurance company restores the sum insured completely or up to a certain percentage after the sum insured is completely exhausted from treatment. This percentage of the restoration amount may vary from plan to plan.

Exclusion Under Senior Citizen Health Insurance

Below mentioned are the situations and conditions that are not covered under Senior Citizen Health Insurance Plans:

- Self-inflicted injury

- Dental treatment

- Obesity Treatment

- Abuse of drugs and alcohol

- Adventure sports

- IVF Treatment

- Cosmetic Treatment

- Injuries arise during a war-like situation

- Breach of law/criminal activity

Why Buy Senior Citizen Health Insurance Online?

Below mentioned are the benefits to buy senior citizen health insurance online:

- Compare premium quotes

- Transparency

- Availability of Value-added riders

- Secure payment platform

- Abdunce of choice

- Discounted premiums

Things to Consider While Buying Senior Citizen Health Insurance

Several important factors must be considered when buying a senior citizen mediclaim policy. Here are some key things to keep in mind:

Cashless Hospitalization

Every health insurance company has a long list of network hospitals where you can get cashless hospitalization. Before buying a senior citizen health plan, always check your insurer's network hospital list. This will help you determine whether your nearest hospital is on the list.

Health Insurance Claims

When buying health insurance for senior citizens, always check the claim settlement ratio and the time the insurance company takes to settle the claim. If the claim settlement time is short and the company's claim settlement ratio is high, your claim will likely be settled quickly.

No Claim Bonus

Health insurance companies reward policyholders with an increase in the sum insured through a no-claim bonus for each claim-free year. In such cases, the sum insured of senior citizen health insurance increases from 20% to 100%.

Copay

A copay in health insurance means co-payment. Many health insurance companies impose a copay clause under their senior citizen health insurance plans. Under this copay clause, the policyholder pays a percentage of the hospitalization expenses, and the insurance company pays the rest.

Waiting Period

Pre-existing diseases are common among older people, and their treatment can drain all your savings. Hence, always choose your senior citizen health plan with a minimum waiting period for pre-existing diseases.

Network Hospitals

Senior Citizen Health Insurance Policy Buying Process

You can buy senior citizen health insurance from the insurance company’s official website and “RenewBuy.com”. Below are both the buying processes of senior citizen health insurance plans:

Buying process from the official website

Visit the insurance company’s official website and click on the “Senior Citizen Health Insurance” tab.

Select the desired plan.

Fill in all the required information.

Click on Buy Now button.

Make payment.

The insurance company will send the policy documents to your email address.

Buying Process from “RenewBuy.com”

Visit the official website of RenewBuy.

Click on the “Health Insurance” tab.

Fill out the form that shows on the next page.

Compare health plans and select your desired senior citizen health plan.

Click on the “Buy Now” button

A pop-up will show you the plan details and the additional riders information.

Click on the “Proceed to Buy” button.

Make online payment and the policy documents will be sent to your registered email address.

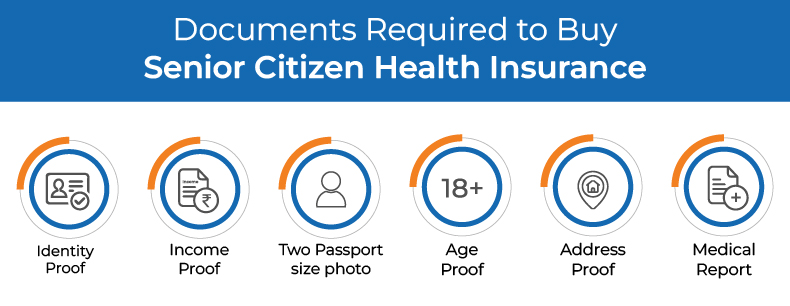

Documents Required to Buy Senior Citizen Health Insurance in India

The following are the documents required to buy a senior citizen health insurance plan in India:

Identity Proof

Income Proof

Two Passport size photo

Age Proof

Address Proof

Medical Report

Why Buy Senior Citizen Health Insurance From RenewBuy?

Below are the reasons to buy a health insurance plan for a senior citizen from RenewBuy

Free comparison of plans

IRDA approved company

24x7 Customer support

Safe and Quick Buying Process

Senior Citizen Health Insurance Claim Process

Two types of claim settlement processes are offered under Senior Citizen health insurance plans: the Cashless claim process and the Reimbursement claim process.

Cashless Claim Process

Intimate the insurer within 48 hours of hospitalization

Fill out and submit the claim form

Submit the other necessary documents

Once the claim is approved, the insurer will settle the medical bills directly with the hospitals.

Reimbursement Claim Process

Intimate the insurance company

Collect the original discharge summary.

Fill and submit the claim form along with the ID proof

The insurance company will verify the documents

Once the verification is done, the insurance company will initiate the reimbursement process.

Senior Citizen Health Insurance Renewal Process

Senior citizen health insurance can be renewed via two platforms, online and offline. Below are both the renewal processes of health insurance for senior citizens in detail:

Online Process

Visit the official website of the insurance company.

Select "Renewals" from the menu section.

Enter your policy number and Date of Birth.

The next page will show you the amount that you need to pay.

You can also customize your individual mediclaim plan as per your needs.

Once you did the Renewal payment, your policy details will be sent to your registered e-mail address.

Offline Process

You can renew your senior citizen health policy by visiting the nearest insurance company branch. You can also contact RenewBuy POSP advisors to get assistance for the renewal of your Senior Citizen Health Plan.