Introduction

Life Insurance Corporation (LIC) is one of the prominent life insurers in India, servicing customers in rural and urban areas. The company serves cost-effective plans in various categories, including term life insurance, endowment plans, health insurance, pension plans, ULIP plans, micro insurance, group insurance, etc. As per the suitability and requirements, the customers can select the policy and coverage term to enjoy the benefits.

However, with the shift in lifestyle, customers' needs change, and policies purchased in the past can become insufficient to cover the current or future benefits. In such cases, customers must surrender the policy before the policy tenure is completed. Upon cancellation of the LIC policy, the surrender value is payable to the customers. Surrendering LIC policy is quite as simple as purchasing a new one. This article will discuss the LIC surrender value and its calculation in detail.

What Does it Mean to Surrender an LIC Policy?

When a policyholder opts to close or terminate the LIC policy before the completion of the tenure, i.e. before maturity, it is called the surrender of the policy. The policyholder can cancel the LIC policy anytime, whenever they want to. Upon the LIC policy surrender, the life coverage and other benefits stop immediately, and you cannot claim them in the future.

Surrendering your LIC policy is not recommended, as the surrender value you receive is substantially lower than the original policy benefits promised.

When Can a Policyholder Surrender the LIC Policy?

The guidelines for surrendering an LIC policy vary per the LIC life insurance policies mentioned under the terms and conditions. The LIC policy termination period depends on the policy and premium paying terms. The minimum period is calculated from the date at which the policy is purchased. In general, the policyholder can discontinue their policy under the following instances:

For Single Premium Payment Plans

Under a single premium policy, the policyholder pays the entire policy premium at the time of policy purchase. In this case, the policyholder can surrender the LIC policy after completing at least two years. No surrender is allowed in the first year of the policy.

For Regular or Limited Premium Payment Plans

Under regular or limited premium payment policies, the policy tenure is considered when the policy surrender is possible. The closure of the LIC policy is done in the following way:

- For LIC policies having a policy term of ten years or less, the surrender of LIC policy is allowed after the completion of two full policy years.

- For LIC policies having a policy term of more than ten years, the surrender of LIC policy is possible after the completion of a minimum of three policy years.

Pro Tip: Surrendering a term life insurance plan without the maturity benefit leads to LIC policy lapse.

Learn how you can revive lapsed LIC policy.

Types of LIC Policy Surrender

Generally, two types of surrender values are offered under LIC policy: Guaranteed Surrender Value and Special Surrender Value, which are calculated in the following way:

Guaranteed Surrender Value

When the policyholder pays LIC premiums for at least three policy years, a guaranteed surrender value is payable. The surrender value is equal to 30% of the total premium paid until the date of surrender, excluding any premium paid towards the add-ons or the premium paid for the first year.

Special Surrender Value

The special surrender value is comparatively higher than the guaranteed surrender value and is payable as:

- When LIC premium payment is paid for over 3 years but less than 4 years, up to 80% of the assured maturity sum is payable.

- When LIC premium payment is paid for more than 4 years but less than 5 years, up to 90% of the maturity sum assured is payable.

- When LIC premium payment is paid for over 5 years, up to 100% of the assured maturity sum is payable.

Where, the maturity sum assured is calculated based on the LIC premiums paid till the date of the policy surrender using the following formula:

[Original sum assured * (number of premiums paid/ number of premiums payable) + total bonus received] * Surrender Value Factor

* The special surrender value is reviewed and approved from time to time by the Life Insurance Corporation of India with the prior approval of IRDAI.

Key Point to Note: For a ULIP policy, when surrendered during the five-year lock-in period, the Unit Fund Value minus the discontinuation charge is paid at the end of the lock-in period in the form of the surrender value. When the ULIP policy is surrendered after the five-year lock-in period, the unit fund value as available on the date of the surrender is paid to the policyholder.

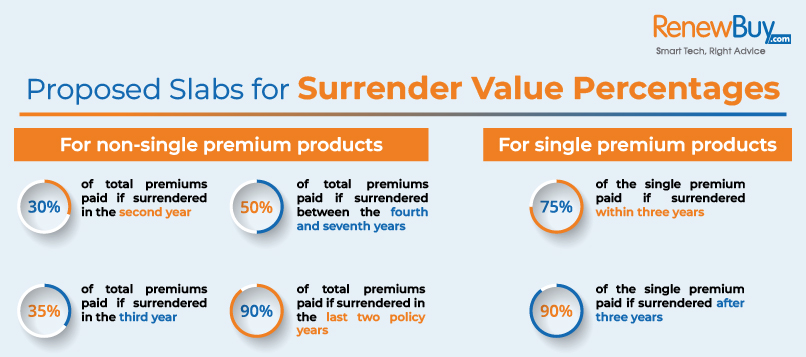

Latest IRDAI Announcement on Surrender Value of Life Insurance Policies, Come Into Effect From April 1, 2024

How to Surrender an LIC Policy?

LIC of India has laid down strict rules and regulations regarding the surrender of LIC policies. While a LIC policy can be surrendered anytime after the premium payment of two full policy years, ULIP policies can only be surrendered after the five-year lock-in period. Upon surrender, you receive a monetary amount as surrender value.

Follow the given steps to surrender the LIC policy:

Intimate the Life Insurance Corporation by filling out an intimation form.

Visit the nearest LIC branch and avail of the LIC surrender discharge voucher (Form 5074). You can also download the form from the official website of LIC India.

Duly fill out the form and submit it with the relevant documents. Along with that, you need to send a letter to the LIC of India stating the reason for policy cancellation via email or post it to the postal address of the LIC.

Upon receiving the request, the company will evaluate the application.

If found satisfactory, the surrender value will be credited to the bank account of the policyholder.

What Documents Do I Need to Surrender My LIC Policy?

The following documents are required if you want to surrender your LIC policy:

Surrender discharge voucher- LIC Form 5074

Application to surrender the policy with the reason specified

LIC NEFT mandate form

Valid identity proof such as an Aadhaar Card, Voter Card, PAN card, etc.

Original policy bond

A cancelled cheque from the bank of the policyholder

Any other document as demanded by the corporation

When Should You Surrender Your LIC Policy?

LIC of India offers comprehensive policies to fit the different financial needs of individuals from diversified social backgrounds. However, surrendering your LIC policy is your personal decision that solely depends upon your changing needs and future goals. Here are some practical reasons why you might choose to surrender your LIC policy:

Financial Hardship

If you're facing financial difficulties and cannot continue paying premiums, surrendering your LIC policy can be an option.

Change in Financial Goals

Your financial goals change over time. If your current LIC policy no longer aligns with your financial objectives, surrendering it might be a sensible decision.

Better Investment Opportunities

Chances are that you have found other investment avenues that offer higher returns or better benefits than your existing LIC policy. Surrendering the policy redirects those funds to new opportunities.

Insurance Needs Change

Your insurance needs may evolve over time due to changes in your life circumstances, such as marriage, children, or retirement planning. Surrendering your LIC policy and opting for a different insurance option that better suits your current needs could be beneficial.

Dissatisfaction with Policy Performance

If your LIC policy hasn't performed as expected or the surrender value has become significant enough to meet your needs, surrendering it might be helpful.

Remember, surrendering an LIC policy is a significant decision that should be considered after comparing all the pros and cons. We suggest you review your policy documents carefully, understand the surrender value, and consult with a financial advisor if needed before making a final decision.

How is the Surrender Value Different from the Paid-Up Value?

If the policyholder decides to surrender the policy, they cannot enjoy the coverage, and the surrender value generated is low. So, the policyholder can opt to make the policy a paid-up value.

If the policyholder has made LIC premium payments for at least two full policy years, and any subsequent premiums are not duly paid. In such a case, the policy is not wholly void but continues as a paid-up policy until the end of the policy term.

The two terms, LIC policy surrender and paid-up policy, may seem similar to you; let’s understand the difference between the two with the help of the table below:

| Paid-Up Value | Policy Surrender |

|---|---|

| Paid-up value is released at the time of the maturity of the policy or on the death of the policyholder | Surrender value is paid immediately |

| The coverage continues till the end of the policy maturity | The coverage is terminated immediately upon the surrender |

| Any bonus accumulated till the policy discontinuation date is paid with the paid-up value | No additional benefits or bonuses are payable |

| No future benefits | No future benefits |

| Payment of the premiums stops immediately | Payment of the premiums stops immediately |

What Are the Consequences If I Close LIC Policy Before Maturity?

The decision to surrender an LIC policy disables the policyholder from attaining any predefined benefits under the policy. But if the policyholder goes ahead with LIC policy surrender to fulfil any financial issue or any unexpected circumstances, below are the consequences that may occur:

Loss of Protection

Once the policy is surrendered, you are no longer covered under its protection. This ultimately puts you and your family in a difficult situation against any unexpected twists and turns of life.

Loss of Benefits

Upon cancelling a LIC policy, you broke the contract between you and the insurer, which means all the benefits associated with the policy are revoked. This leads to a loss of benefits.

No Scope to Revive the Policy

Say you have surrendered a specific policy and, after a few years, want to invest in the same. This time, he/ she has to pay an increased premium amount to secure the same benefits due to increased age and risk factors.

Zero Benefit

If you surrender the policy before the specified surrender period (before the completion of 2 or 3 policy years from the inception of the policy), the surrender value will become zero, resulting in the loss of the premium amount you have paid so far.

No Tax Benefits

Under the Income Tax Act of 1961, the policyholder can avail of multiple tax benefits under Sections 80C, 80D, and 10 (10D) on an insurance policy. However, when you cancel your LIC policy, you can no longer gain those tax benefits.

Bottom Line

Understanding the consequences of surrendering your LIC (Life Insurance Corporation) policy is important for making informed financial decisions. Whether you're facing financial challenges, reassessing your insurance needs, or seeking better investment opportunities, if you know the process and implications of surrendering your LIC policy, you will navigate your financial journey confidently.

Consulting with financial advisors and utilizing online tools provided by LIC can further assist you in this process. You can log in to the LIC customer portal to track your LIC policy.