Health Insurance Premium Calculator

Health Insurance Premium Calculator helps you to determine the premium to be paid for purchasing or renewing your insurance policy. In the modern era, even the most complex calculations can be done with the help of computers. Health Insurance Premium Calculator is an online tool that takes various inputs and information from the policyholders and allows them to calculate the exact amount to be paid. But, before we discuss the health insurance premium calculator, let us refresh your memory about insurance premiums.

What Do You Understand by Health Insurance Premium?

The health insurance premium is the amount you pay to the health insurance company to avail coverage benefits and ensure that the medical insurance policy remains active. In return for the premium, the insurance company is liable to pay for medical costs and hospitalization expenses if a medical emergency arises or an illness is diagnosed. A health insurance calculator helps you calculate your health insurance premium amount per your coverage needs.

An individual can buy a health insurance plan for a specified period in exchange for paying monthly or annual premiums. During this period, if an insured person is involved in an accident or is diagnosed with an illness, the health insurance company will cover the cost of any medical care required, subject to certain exclusions mentioned in the policy. The health insurance premium is the amount you are expected to pay regularly to keep your health insurance plan active.

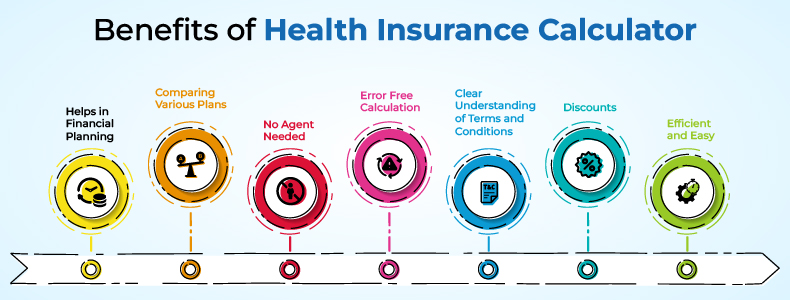

Benefits of Health Insurance Calculator

Health Insurance Premium Calculator not only helps you calculate your premium but also helps you save money by making the right choice. Here are some reasons why you should opt for a Health Insurance Calculator:

-

Helps in Financial Planning

It simplifies the calculation and gives you the exact amount you will need to pay as the premium for your health insurance policy. Hence, you can plan your finances accordingly and invest in the policy that suits your budget.

-

Comparing Various Plans

Health Insurance Premium Calculators work as a family health insurance premium calculator because they make it hassle-free to check out various plans and policies in just a few seconds for your entire family. You can compare different policies and choose the one that rightly suits your family's needs.

-

No Agent Needed

Connecting with an insurance agent is a tedious process. You may or may not get a callback when you require it. Health Insurance Premium Calculators remove the requirement of agents and allow you to evaluate your plans as per your requirement.

-

Error Free Calculation

Since the calculations are done through a computer, there are no chances of error in the math if you input all the requirements correctly. Hence, you get the exact amount you need to pay as a premium.

-

Clear Understanding of Terms and Conditions

It is essential to read and understand all the terms of any policy before finalizing it. A Health Insurance Premium Calculator helps you understand the terms and conditions transparently without withholding any information allowing you to make an informed decision.

-

Discounts

The health insurance calculator also helps you understand the different discounts you can avail of on different insurance policies.

-

Efficient and Easy

The health insurance calculator is easy to use and is efficient in determining the health insurance premium that you need to pay for your health insurance plan. So, you do not have to spend time visiting the branch of an insurance company.

Thus, a health insurance calculator is a quick and easy way to know how much premium you need to pay for a certain policy.

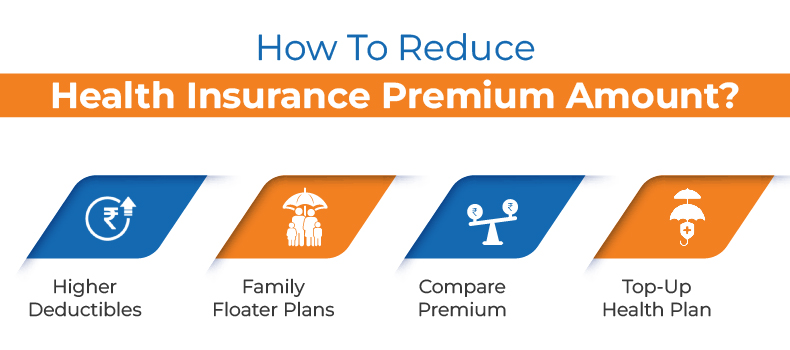

How To Reduce Health Insurance Premium Amount?

Although more and more people understand the importance of health insurance, the premium paid for insurance remains a concern for many people. There are a few ways to lower your policy premiums:

Higher Deductibles

Deductibles mean the percentage of the claim that the insured has to pay out of his pocket. In some health insurance plans, the deduction is mandatory, while in some plans it is voluntary. If you choose the higher deductible option, you will have to pay a lower premium. But it is fair to those who can afford to pay for the treatment if the treatment is expensive.

Family Floater Plans

Under the family floater plans, two or more people of a family are insured in a single policy, and only a single premium is paid. But the sum insured in the policy is available on a floater basis and not on an individual basis. It reduces the amount of premium that you need to pay.

Compare Premium

Although comparing premiums will not help reduce the premium per se, it will help you find a policy that suits your requirements within your budget. If you research well, you will find a policy within your budget that provides you with the required coverage benefits.

Top-Up Health Plan

You can opt for a top-up plan with your policy to enhance the coverage benefits. The premium for top-up plans is less and comes into use when the sum insured of your base policy gets exhausted.

Therefore, these are some tips you can use to reduce the premium. It is essential to know that one should not compromise on coverage to lower the premium by some amount as that can become an issue when a medical emergency arises.

Quick Links

How to use the health insurance calculator by Renewbuy?

RenewBuy provides a simple health insurance calculator to make calculating your premiums as quick and straightforward as possible. The online calculator assists you in determining the rates for various insurance plans, and you will get a free quotation as a result of using it.

The following are the processes that must be completed to compute the premium on Renewbuy:

- Visit the RenewBuy premium calculator page for information.

- Fill out the form that has been supplied to you, with the required information.

- The details you must submit include your gender, age, and phone number.

- Choose between an individual floater plan and a family floater plan.

- Select the number of participants you want to include in the plan.

- In the calculator, enter the amount of the sum insured that you need to be covered.

- You must provide the zip code of the city where you reside.

- Click on the “Instant Quote” button to see the quotations for various insurance plans.

- You may also personalize the estimates based on riders, plan features, and pre-existing conditions.

You will now see a list of insurance plans, the amount of premium you will be required to pay, and the benefits you will receive. Select the insurance package that best meets your needs and fits your budget. If you have any questions, you may also contact RenewBuy customer care.

Factors Affecting the Cost of Health Insurance Premium Calculator

Health insurance premium prices may be affected by various variables, so it's essential to be aware of them before purchasing. Gender, age, body mass index (BMI), and other personal characteristics are all considered while calculating your premium.

Desired Plan

Your premium highly depends on the plan that you choose. Whether your plan is for an individual, your family, or a top-up health plan will decide the premium you are going to be paying for the policy.

Age

Age is a crucial factor in determining the premium you would pay. As the age increases, the premium also increases because one becomes more prone to health issues, and the likelihood of claiming the policy increases.

Pre-existing Health Conditions

The policyholder or applicant has to submit their medical documents for pre-existing medical issues. For pre-existing conditions, the health insurance company may include or exclude them in its plans. If the policyholder does not submit required documents for the pre-existing conditions, they become responsible for additional expenses and increased premium.

BMI

Compared to people with normal BMI, people with higher BMI have to pay higher premium amount. This comes from the fact that people with high BMIs are prone to various health problems including heart disease, arthritis and diabetes, etc.

Lifestyle

Lifestyle is an important factor when determining the premium for your health insurance. People who smoke, chew tobacco, or drink regularly are often denied insurance by insurance providers, as cancer and other life-threatening diseases affect them the most, resulting in an impact on their premiums.

Location

Your location or the city you live in can also be a deciding factor in your insurance premium. Many insurance companies determine factors like extreme weather conditions or healthy food availability in the area you live to compute the premium amount.

No Claim Bonus

No Claim Bonus is a reward that the policyholder receives for not making any claims during the year of the policy. As a result, the policyholder gets added benefits like a reduced premium on the policy.

Add-On Covers

Another factor that is a key factor in driving your premium price is add-on covers. If you are adding an add-on rider to your policy, you would be required to pay a premium for that, increasing the premium for your overall policy.

Network Hospitals

Tax benefits of health insurance calculator

When it comes to ensuring total security during medical crises for you and your family, health insurance is one of the most important investments that anyone can make. Aside from the fact that health insurance plans may save you a lot of money on medical expenditures, they also offer appealing tax advantages. Hence, many people invest in life and health insurance due to the added advantages.

Tax advantages are available on the premiums paid for health insurance. Section 80D of the Indian Income Tax Act allows you to deduct your health insurance premiums from your taxable income. Hence, the amount you pay as a premium for your health insurance coverage may be deducted from your taxable income, making it a significant benefit (subject to certain limits). As a result, your taxable income and your relevant tax will be reduced.

Conclusion

Health insurance companies establish your health insurance premium after evaluating your lifestyle, medical history, pre-existing conditions, and other comparable criteria. In addition, most health insurance carriers have their own set of criteria, and they base their quote prices on these characteristics. However, you can try out the Health Insurance Premium Calculator to get answers to a lot of your insurance-related queries.