Family Health Insurance Plans

Health insurance is a very diverse and vast industry. There are different types of health insurance plans in India. Each health plan is designed to meet the unique needs of each individual. Just like family health insurance plans are designed to meet the family's medical needs. Family health plans are designed for the medical needs of the family keeping in mind the age, budget, health problems, and medical needs of the family.

What is Family Health Insurance?

A family health insurance plan provides health coverage to the entire family. You can cover a maximum of 6 members of a family under the single Family Health Plan. Under a family insurance plan, you have to pay a single premium amount and the total sum insured will be divided among all the covered members.

A family medical insurance plan can cover you, your spouse, your dependent children, your parents, and even your in-laws. Family medical insurance policies offer various coverage benefits such as cashless hospitalization, maternity benefits, pre and post-hospitalization, etc. COVID-19 hospitalization is also covered under family health insurance plans.

For Instance: Akash buys a family health insurance plan for a family of 4 members with a sum insured of Rs.10 lakhs. All four people together can spend a total of 10 lakh rupees in a year. If a family member uses the sum insured of Rs 5 lakh, then only Rs 5 lakh is left for the rest of the family members in the policy year.

Eligibility Criteria to Buy Family Health Insurance Plan

Every Health plan comes with eligibility criteria. The below table shows the eligibility criteria to buy family health plans in India:

| Particular | Eligibility Criteria |

|---|---|

| Minimum Entry Age | Adult: 18 years, Children: 90 days |

| Minimum Exit Age | Adult: 65 years, Children: 25 Years |

| Family Members Covered | Up to 6 members (You, your spouse, dependent children, dependents parents, and parents-in-law) |

| Renewability | Lifelong |

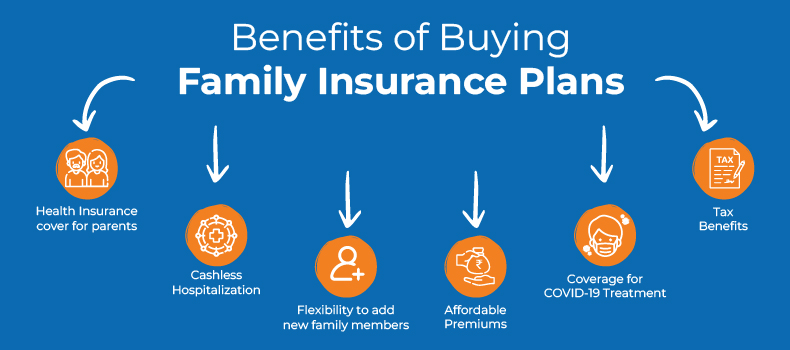

Benefits of Buying Family Insurance Plans in India

A family health insurance plans offer various benefits to the policyholders. For example, You can cover all your family members under a single health insurance policy. Below mentioned are the major benefits that you can avail yourself of from buying a family health insurance plan.

-

Health Insurance cover for parents

You can cover your elderly parents and parents-in-law along with you and your children under a single health insurance policy at no additional premium amount.

-

Cashless Hospitalization

You can avail of cashless medical treatment for yourself and your family members in case of hospitalization in a network hospital.

-

Flexibility to add new family members

Family Health Insurance plans provide the flexibility of adding new members to your existing family health plan at the time of renewal.

-

Affordable Premiums

You can cover your entire family (your spouse, child, parents, parents-in-law) at an affordable premium amount. That means you don’t have to pay individual premiums for every family member.

-

Coverage for COVID-19 Treatment

Under a family health insurance policy, you can get coverage for the treatment of COVID-19 for the entire family. You can also buy the “Corona Kavach” policy which covers the cost of hospitalization due to treatment of Coronavirus on a family floater basis.

-

Tax Benefits

You can avail of tax benefits on the premium paid for a family health insurance plan under Section 80D of the Income Tax Act.

What is Covered Under Family Health Insurance Plan?

The following are the coverage benefits offered under the family health insurance plan:

-

In-patient Hospitalization

A family health insurance plan covers all hospitalization expenses of the insured family member if the insured remains hospitalized for 24 hours or more.

-

Pre-Hospitalization

Medical expenses incurred before the hospitalization of the policyholder are covered up to a certain number of days under family health plans.

-

Post-Hospitalization

Medical expenses incurred after the discharge from the hospital are covered under Family health insurance plans in India.

-

Daycare Treatment

family insurance policy covers treatments that do not require hospitalization of more than 24 hours.

-

Domiciliary hospitalization

Family health insurance plans cover expenses incurred due to home hospitalization due to the non-availability of medical facilities in hospitals.

-

AYUSH Treatment

Alternative treatments such as Ayurveda, Yoga & Naturopathy, Unani, Siddha, and Homeopathy are also covered under Family Health Plans.

-

Hospital Daily Cash

Policyholders will get some cash amount each day during the time of hospitalization under the family health policy.

-

Annual Health Check-up

family health policy offers free annual health checkups to the insured policyholders.

-

Emergency Ambulance

The family mediclaim policy covers the charges of ambulance service in case of a medical emergency.

-

Maternity

The family health insurance plan covers the cost of maternity-related expenses as well as newborn expenses.

-

Mental illnesses

Family health insurance covers mental illnesses such as depression, anxiety, etc.

-

Organ Donor

A family insurance policy covers the cost of replacing or removing the malfunctioning organs from the body.

Best Family Health Insurance Plans in India

many health insurance companies are offering various family health insurance plans in India. Finding the best mediclaim policy for family can be a daunting task for the customers. To make it easier for you, D2C Insurance Broking Private Limited (“RenewBuy”) has put together a list of "Best Family Health Insurance Plans in India" along with some of its coverage benefits in the table below:

|

ManipalCigna LifeTime Health Plan |

Coverage Benefits

- Restoration

- Coverage outside India

- Mental Care

Eligibility Criteria

Sum Insured: 50 Lakhs to 3 Cr

Entry Age: 91 days to 65 years

|

HDFC Optima Restore Plan |

Coverage Benefits

- Domiciliary Hospitalization

- Pre and Post Hospitalization

- Cataract

Eligibility Criteria

Sum Insured: 3 Lakhs to 50 Lakhs

Entry Age: 91 days to 65 years

|

Care Plan |

Coverage Benefits

- Organ Donor Cover

- Ambulance Cover

- Domiciliary Hospitalization

Eligibility Criteria

Sum Insured: 3 Lakhs to 75 Lakhs

Entry Age: 91 days to no upper age limit

|

Care Advantage |

Coverage Benefits

- Organ Donor

- Auto Recharge

- Daycare Treatment

Eligibility Criteria

Sum Insured: 25 Lakhs to 1 Cr

Entry Age: 91 Days to lifelong

|

Nivabupa Reassure |

Coverage Benefits

- Emergency Ambulance

- AYUSH Treatment

- Day Care Treatment

Eligibility Criteria

Sum Insured: 3 Lakhs to 1 Cr

Entry Age: 18 years to 65 years

*Disclaimer: We RenewBuy does not endorse any specific insurance company or insurance product offered by any insurer and this list is just an illustration of the plan offered by different health insurance companies

Common Exclusions Under Family Health Insurance Plans

There are some common exclusions that are not covered under family health insurance plans. Below mentioned are the medical treatments and medical situations that are usually excluded from the family health plan:

- OPD Treatments.

- HIV/STDs (sexually transmitted diseases).

- Drug and alcohol abuse

- Injuries that happened due to war, nuclear reactions, etc.

- Injuries incurred due to participating in criminal activities, and adventurous sports.

Quick Links

Things To Consider Before Purchasing a Family Health Insurance Plan

There are a few points you need to consider before buying a mediclaim policy for family. These points will help you buy the right family insurance policy for your loved ones in case of a medical emergency.

Sum Assured

Check the sum insured offered under the family health insurance plan. Always opt for the plan which offers a higher sum insured due to the high inflation rate and the rising cost of medical treatment in the country

Coverage

While choosing a family health insurance plan, you should consider the medical expenses of your family members. It is important to consider the coverage benefits offered under a family health policy. It will also be helpful if you compare different family health policies to determine which one best fits your needs

Availability of Cashless Hospitalization

Today, almost all insurers offer cashless hospitalization facilities in their network hospitals. This makes the hospitalization process smooth and hassle-free. But before you buy a family health insurance policy, check the list of network hospitals to see if these hospitals are available near you

Flexibility

The cost of health care is increasing rapidly due to the high inflation rate in the country. Most health insurance companies allow you to increase the sum insured amount at the time of renewal. But this is something you need to check with your insurer. Hence, it is advised to contact them and clear all your doubts regarding this

Maximum Renewal Age

Many health insurance providers allow policy renewal till the age of 60-65 years of the policyholder. While some insurers offer lifetime renewable options. So, make sure you choose a family insurance policy that will protect you when you need it the most

Hassle-Free Claim Settlement Process

Before buying a Family health policy for your family, make sure you understand the claim settlement process of the health insurance company. Always choose a health insurance company that offers a simple, quick, and hassle-free claim settlement process

Network Hospitals

How to Buy Online Mediclaim Policy for Family with RenewBuy?

To buy a family health insurance policy from the comfort of your home, you can purchase it through an online platform with RenewBuy. Below mentioned are the steps that you need to take:

- Select your gender and enter your details

- Enter your pin code and sum insured that you need

- You can add the family members that you wish to include in the policy

- You will get instant quotes of different policies that you can purchase

- Once you have chosen the right policy, select 'Buy Now’

- In the next window, you will see the option of adding 'Add-On Covers'

- Once you are done, you need to submit all your details on the next page

- Next, you can pay the premium for the policy, and the policy will be issued to you

- Once this is done, the policy is mailed to you at your e-mail address

These are the steps that you need to take if you want to buy an insurance policy online. It is a convenient and hassle-free process.

Family Health Insurance Claim Settlement Process

Family Health insurance plans offer two types of claim settlement modes i.e. cashless claim and reimbursement claim. Below mentioned are the steps to file a claim under both types of claim processes:

Cashless Claim Process

In Case of Planned Hospitalization

- Inform the health insurance company before 48 to 72 hours of hospitalization.

- The health insurance company will provide you with a confirmation letter.

- The policyholder needs to submit the relevant documents along with the confirmation letter and health card at the hospital desk.

- The insurance company will directly settle the bill with the hospital.

In Case of Emergency Hospitalization:

- Inform the insurance company about the hospitalization within 24 hours

- Fill in the claim form and submit it.

- The policyholder needs to submit the required documents

- The health insurance company will provide an authorization form to the hospital.

- The medical bill will be directly settled by the insurance company.

Reimbursement Claim Process

- Intimate the Health insurance company

- Collect the original discharge summary.

- Fill and submit the claim form along with the ID proof

- The insurance company will verify the documents

- Once the verification is done, the insurance company will initiate the reimbursement process.