Cashless Health Insurance Plans in India

A healthy lifestyle is a luxury that not everyone can afford. We know that nowadays, the inflation in the country is so high, and due to high inflation, it is almost impossible to save money and live comfortably at the same time. We spend our whole life earning our livelihood. But life is unpredictable, and even a small incident can wipe out your entire life savings. Hence, everyone needs to buy a cashless health insurance plan in India as it provides you with the facility of cashless hospitalization and medical treatment benefits.

What is Cashless Health Insurance?

Cashless health insurance is a type of health insurance plan that provides a cashless claim facility to the policyholder. Under the cashless claim facility, the policyholder is not required to pay the hospitalization bill in the network hospital as the health insurance company will settle the bill directly with the hospital on behalf of the policyholder.

A cashless health insurance policy provides financial coverage to the insured during a medical emergency. It is an arrangement between the health insurance companies and the network hospitals, where the policyholder is not required to pay the medical bills.

Health Insurance Companies Offering Cashless Mediclaim Policy

Below mentioned is the list of 28 health insurance companies in India offering cashless mediclaim policy:

| S.No. | Insurance Company | Claim Settlement Ratio 2020-21(claim settled within 3 months) | Solvency Ratio (2020-21) |

|---|---|---|---|

| 1. | Acko General Insurance | 93.65 | 2.75 |

| 2 | Aditya Birla Health Insurance | 99.73 | 1.95 |

| 3 | Bajaj Allianz General Insurance Company | 94.73 | 3.15 |

| 4 | Bharti AXA General Insurance | 92.81 | 1.70 |

| 5 | Care Health Insurance | 100 | 2.52 |

| 6 | Digit General Insurance | 94.24 | 2.61 |

| 7 | Cholamandalam MS General Insurance Company | 92.94 | 1.95 |

| 8 | Edelweiss General Insurance | 97.80 | 2.02 |

| 9 | Future Generali India Insurance Company | 93.74 | 1.62 |

| 10 | HDFC ERGO General Insurance Company | 98.36 | 2.02 |

| 11 | ICICI Lombard | 96.93 | 2.72 |

| 12 | IFFCO Tokio General Insurance Company | 82.57 | 1.72 |

| 13 | Kotak Mahindra Health Insurance | 96.01 | 2.12 |

| 14 | Liberty Videocon General Insurance | 95.57 | 2.86 |

| 15 | Magma HDI General Insurance Company | 93.63 | 1.78 |

| 16 | Manipal Cigna Insurance Company | 99.97 | 2.43 |

| 17 | Niva Bupa Insurance Company | 99.93 | 1.82 |

| 18 | National Insurance Company | 57.80 | 0.36 |

| 19 | Navi General Insurance | 99.99 | 2.35 |

| 20 | New India Assurance Company | 86.51 | 2.13 |

| 21 | Oriental Insurance Company | 91.22 | 1.36 |

| 22 | Raheja QBE General Insurance Company | 95.51 | 3.33 |

| 23 | Reliance General Insurance Company | 98.59 | 1.62 |

| 24 | Royal Sundaram Alliance Insurance Company | 97.74 | 2.08 |

| 25 | SBI General Insurance Company | 99.75 | 2.20 |

| 26 | Star Health and Allied Insurance Company | 99.64 | 2.1 |

| 27 | Universal Sompo Insurance Company | 94 | 1.95 |

| 28 | Tata AIG General Insurance Company | 90.78 | 2.17 |

*Data has been Sourced from annual report of IRDAI 2020-21

Coverage Benefits under Cashless Health Insurance Plans

Cashless health insurance plans have a wide range of coverage benefits that cover every aspect of medical emergencies. Various types of health plans in India fulfill the healthcare requirement of individuals, senior citizens, women, families, and various other groups. Today, almost every health insurance company provides cashless health insurance plans in India. Below mentioned are some of the common coverage benefits offered under cashless health insurance plans in India:

- In-patient hospitalization expenses

- Pre and post-hospitalization expenses

- Maternity Benefits

- AYUSH Treatments

- Day care procedures

- Domiciliary treatments

- Hospital daily cash

- Emergency ambulance cover

- Coverage for pre-existing diseases

- No claim bonus (NCB)

- Free health check-ups

- Organ donor cover

- Critical illness cover, etc.

Best Cashless Health Insurance Plans in India

Many health insurance companies are offering various cashless health insurance plans in India. Hence, finding the best cashless health insurance policy can be difficult. We RenewBuy has made a list of the best cashless health insurance plans in India along with its key features in the below table:

| S.No. | Insurance Company | Plan Name | Key Features | Network Hospitals |

|---|---|---|---|---|

| 1. | Niva Bupa Health Insurance | Niva Bupa Health Reassure Plan |

|

7600+ |

| 2. | Care Health Insurance | Care Plan |

|

16500+ |

| 3. | ManipalCigna Health Insurance | ManipalCigna Pro-Health Plan |

|

6500+ |

| 4. | HDFC ERGO Health Insurance | HDFC ERGO Optima Restore Plan |

|

13000+ |

| 5. | Care Health Insurance | Care Classic |

|

16500+ |

*Disclaimer: We RenewBuy does not endorse any specific insurance company or insurance product offered by any insurer and this list is just an illustration of the plan offered by different health insurance companies

Niva Bupa Health Reassure Plan

Niva Bupa Reassure is a type of health plan that provides health insurance coverage to you and your family with a health cover of up to INR 1cr.

Some of the coverage benefits under this plan:

- ICU Charges

- COVID-19 Treatment

- Domiciliary Hospitalization

- Daycare Treatment

- AYUSH Treatment

Care Health Insurance Plan

A care plan is a comprehensive health insurance plan that provides medical coverage to individuals and families. Care Mediclaim policy offers you a higher sum insured to secure the present and future of you and your family in case of a medical emergency.

Some of the coverage benefits under this plan:

- Automatic restoration

- Hospital Daily Cash

- Organ Donor

- Modern Treatment

- Air Ambulance Cover

ManipalCigna Pro-Health Plan

ManipalCigna Pro-Health plan is a comprehensive health insurance plan that provides cashless hospitalization for you and your family with a sum insured amount of 1cr.

Some of the coverage benefits of this plan:

- Expert Opinion on Critical Illness

- Hospital Daily Cash

- Domiciliary Treatment

- Daycare Treatment

- Ambulance Cover

HDFC Ergo Optima Restore Plan

HDFC Ergo Optima Restore plan is a comprehensive health insurance plan that comes under two variants i.e. Optima Restore Individual, and Optima Restore Family.

Some of the coverage benefits of this plan:

- Domiciliary Hospitalization

- COVID-19 Treatment

- Hospital Daily Cash

- Modern Treatment

- Daycare Treatment

Care Classic Plan

Care Classic is a family floater health insurance plan that provides health insurance to the whole family under a single health plan.

Some of the coverage benefits of this plan:

- IVF Treatment

- Free Doctor Consultation

- OPD Charges

- Cataract Treatment

- Pre and Post-Hospitalization

What Are The Exclusions Under Cashless Health Insurance Plan?

Below mentioned are the specific items, treatments, and situations that are not covered under the cashless mediclaim policy:

- Registration Fees

- Admission Charges

- Service Charges

- Attendant Fees

- Consumable Charge

Quick Links

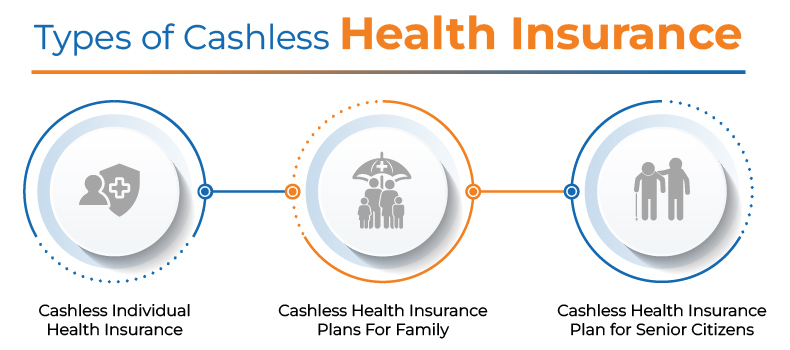

Types of Cashless Health Insurance plans in India

Health insurance is one of the essential things in life as it can be a saviour at the time of a medical emergency. There are various types of cashless health insurance plans in India. Take a look at the different types of cashless health insurance policies in India:

Cashless Individual Health Insurance

Cashless individual health plan is a type of health insurance plan that provides cashless hospitalization to the individual.

Cashless Health Insurance Plans For Family

Cashless family health insurance is a type of health insurance plan that provides cashless medical coverage to the entire family in a single health insurance plan.

Cashless Health Insurance Plan for Senior Citizens

A cashless senior citizen health plan is a type of health insurance plan that provides cashless medical coverage to older people or persons above 60 years of age.

Why Choose Cashless Health Insurance From RenewBuy?

RenewBuy brings you the best deals on Health Insurance plans across the market. The key reasons for you to consider us are as follows:

- Compare Various Health Plans in Just a few Clicks

- Simple & Easy Buying Process

- 24x7 Claim Assistance

Other Popular Mediclaim Insurance Policy in India

Below mentioned are some of the other popular types of health insurance plans in India:

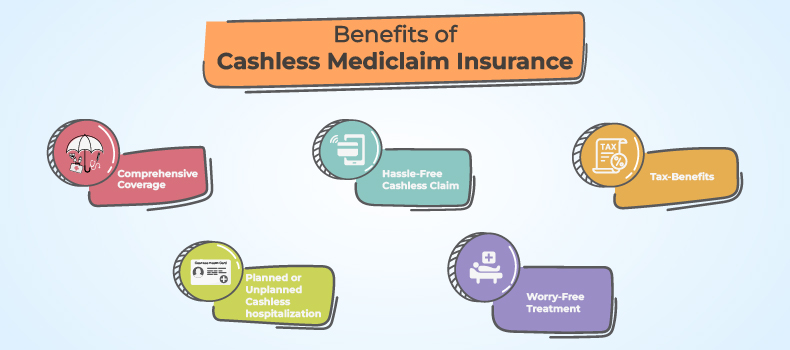

Benefits of Cashless Mediclaim Insurance in India

A cashless mediclaim insurance plan is a type of health insurance plan that offers various benefits during a medical emergency. Below-mentioned are some of the benefits of cashless health insurance plans:

- Comprehensive Coverage

- Hassle-Free Cashless Claim

- Tax-Benefits

- Planned or Unplanned Cashless hospitalization

- Worry-Free Treatment

Things to Remember While Buying Cashless Health Insurance Policy

The following are the important factors that you need to consider before buying a cashless health insurance policy:

- Sum Insured Amount

- Coverage Benefits

- Network Hospitals

- Claim Settlement Ratio

- Co-Payment Option

- No-Claim Bonus

- Exclusions

- Waiting Period

- Add-on Riders

- Premium Amount

Network Hospitals

Cashless Health Insurance Plan Buying Process

You can buy a cashless health insurance plan from the official website of the health insurance company and “RenewBuy”. Below mentioned are both the buying process of cashless health insurance policies:

Buy from the official website of the insurance company

- Visit the official website of the health insurance company and click on the “Health Insurance” tab.

- Choose the desired plan.

- Fill in all the required information.

- Click on the “Buy Now” button.

- Make payment.

- The health insurance company will send the policy documents to your email address.

Buy from “RenewBuy”

- Visit the "RenewBuy" official website.

- Click on the “Health Insurance” section.

- Fill out the form shown on the next page.

- Compare different health insurance plans.

- Choose your desired health plan.

- Click on the “Buy Now” button

- The next page will show you the plan details and the additional riders information.

- Click on the “Proceed to Buy” button.

- Make the online payment

- The insurance company will send policy documents to your registered email address.

Cashless Health Insurance Claim Process

The cashless health insurance claim process depends on the type of hospitalization, i.e. Cashless Planned Hospitalization or Cashless Unplanned Hospitalization.

Cashless Planned Hospitalization Claim Process

- Inform the hospital two days before the hospitalization.

- Fill out the pre-authorization form and submit it to the hospital or TPA.

- The hospital will send all the documents to the health insurance company for verification.

- The insurance company will verify the documents and provide their approval for the treatment.

- The insurance company will issue a confirmation letter to you(valid for only seven days).

- Once you receive the approval letter, you can admit to the hospital.

Cashless Unplanned Hospitalization

- Intimate your health insurance company within 24hrs of hospitalization.

- Submit the below-mentioned documents for the cashless process

Xerox of insurance document

Health Card

ID proof

Address Proof

Duly filled claim form - Submit the cashless claim form and submit it to the health insurance company

- After submission of the claim form, the insurance company will verify the documents and issue an authorization letter to the hospital.

- Now, you can take cashless medical treatment where you do not have to pay the bill amount as your health insurance company will directly settle it.

Documents Required For Cashless Claim Process

Below mentioned are the certain common required documents to file cashless claims:

- Duly filled and signed claim form

- Doctor’s Prescription

- Discharge summary

- Treatment details along with original medical bills and receipts

- Diagnosis reports and bills (ECG/Scan/X-ray, Lab test reports, etc.)

- Police first investigation report (FIR) in case of an accident

- Copy of Health card

Disclaimer: The information published in this article is for the reader′s reference only. The content of this information is to provide an overview of your health insurance needs and should not be relied upon for personal, medical, legal, or financial decisions; you should consult an appropriate professional for specific advice. The Company makes no representations about the suitability, reliability, timeliness, and accuracy of the information, services, or any other items mentioned on this subject for any purpose whatsoever.

Disclaimer:

The details, facts, or figures given here are intended solely for the reader's informational purposes and should not be relied upon for personal, medical, legal, or financial decisions. Please visit the insurer's website for the latest updates. We do not endorse any particular insurance company or insurance product provided by any insurer.