Individual Health Insurance Plans

Ever since COVID-19 affected India, people have become more conscious about their health. People understand the importance of their health and health insurance. People in India are now looking for comprehensive health insurance plans for themselves. Today people are looking to buy an individual health insurance plan to avail medical benefits and tax benefits.

What is Individual Health Insurance?

Individual Health Insurance is one of the types of health insurance that offers medical coverage to an insured individual. It provides coverage for the expenses incurred due to doctor consultations, hospitalization, surgical expenses, pre and post-hospitalization, etc. It offers flexibility to customize your plan’s coverage as per your health requirement.

Need for Individual Health Insurance

As we all know, healthcare costs are rising in India, and lifestyle changes are also making people more vulnerable to diseases. Individual health insurance plans help policyholders manage their finances in case of a medical emergency.

It is suggested that one should buy an individual health insurance policy that provides comprehensive coverage. An individual health policy is always an ideal option to insure your health as it provides comprehensive medical coverage to the policyholder.

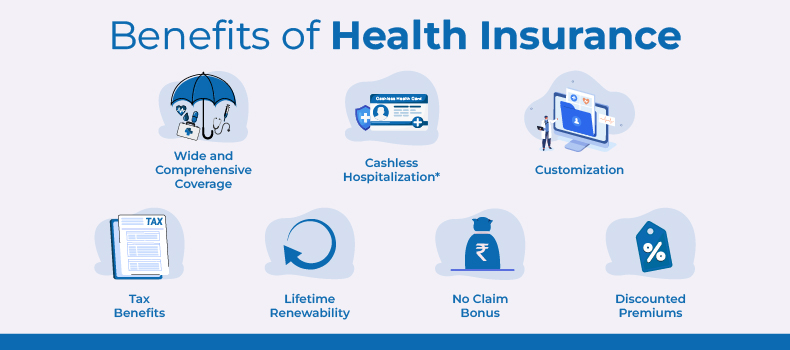

Benefits of Individual Health Insurance

Individual health insurance plans offer various benefits to the policyholders at the time of medical emergencies. Below mentioned are the benefits offered under the individual insurance plans:

Wide and Comprehensive Coverage

Individual health insurance policy offers wide and comprehensive coverage to the policyholders that include pre and post-hospitalization, ambulance charges, in-patient hospitalization, etc.

Cashless Hospitalization

Individual health plans provide cashless hospitalization to the insured at the network hospitals.

Customization

Customers can customize their individual health policy as per their needs.

Tax Benefits

Individual mediclaim policy offers tax benefits under section 80D of the Income Tax Act, on your policy premium paid every year.

Lifetime Renewability

Most individual health plan comes with the benefit of lifetime renewability of plan which means you are financially protected at the time of medical emergencies for the rest of your life.

No Claim Bonus

Individual mediclaim policy offers a No Claim Bonus (NCB) benefit to its policyholders wherein if a policyholder does not file a claim in a year, some percentage of the SI amount will be added to the actual sum assured.

Discounted Premiums

Policyholders will get discounted premiums under individual insurance plans after every timely renewal of the plan.

Eligibility for Individual Health Insurance Plan

Below mentioned are the eligibility criteria to buy an individual health plan:

| Eligibility Criteria | Specifications |

|---|---|

| Minimum Entry Age | 18 Years |

| Maximum Entry Age | 65 Years, 80 years for Senior Citizen Health Insurance |

| Pre-existing medical condition | If you are suffering from any pre-existing medical condition, and you are above 45 years of age, you should undergo a pre-medical check-up to buy an individual health plan. |

Best Individual Health Insurance Plans in India

Various health insurance companies are offering various individual health insurance plans in India. Finding the best mediclaim policy for family can be a daunting task for the customers. To make it easier for you, RenewBuy has put together a list of "Best Family Health Insurance Plans in India" along with some of its coverage benefits in the table below:

*Disclaimer: We RenewBuy does not endorse any specific insurance company or insurance product offered by any insurer and this list is just an illustration of the plan offered by different health insurance companies

What is Covered Under Individual Health Insurance?

In the below section, you will get an insight into the coverage offered under the individual health insurance in India:

Hospitalization

Individual health insurance plan covers all the hospitalization expenses arising due to any diseases and injury.

Pre-Hospitalization

Medical expenses incurred before the hospitalization of the policyholder are covered under individual health plans.

Post-Hospitalization

Medical expenses incurred after the discharge from the hospital are covered under individual health plans.

Daycare Treatment

Individual health insurance plans offer coverage for the treatments that can be treated in less than 24 hours of hospitalization.

Domiciliary hospitalization

Individual health insurance plans cover expenses incurred due to home hospitalization due to the non-availability of medical facilities in hospitals.

AYUSH Treatment

Individual health plans cover various alternative treatments such as Ayurveda, Yoga & Naturopathy, Unani, Siddha, and Homeopathy.

Hospital Daily Cash

Policyholders will get some cash amount each day during the time of hospitalization.

OPD Charges

The doctor’s prescription and the prescribed medical test cost are covered under the individual health insurance plan.

Annual Health Check-up

Individual health plan offers free annual health checkups to the policyholders.

Emergency Ambulance

Individual mediclaim policy covers the charges of ambulance service in case of a medical emergency.

What Is Not Covered Under Individual Health Insurance plans?

The following situations and conditions are not covered under Individual Health Insurance Plans:

- Self-inflicted injury

- Dental treatment

- Obesity Treatment

- Abuse of drugs and alcohol

- Adventure sports

- IVF Treatment

- Cosmetic Treatment

- Injuries arise during a war-like situation

- Breach of law/criminal activity

Quick Links

Coverage After Waiting Period

Below mentioned are the benefits that are covered after the waiting period:

| Particular | Waiting Period |

|---|---|

| Pre-existing period | 2-4 years |

| Initial Waiting Period | 30 days |

| Covid-19 treatment | 15 days |

| Grace Period | 15-30 days |

| Free-look Period | 30 days |

Things to Consider While Buying an Individual Health Insurance Policy

Below mentioned are the factors that you need to consider while buying an Individual medical insurance policy:

Analyze Your Requirements

Before buying an individual health insurance policy for yourself, you need to analyze your requirements. This will help you understand the coverage you need and the riders you need to buy. It is important to consider your lifestyle while deciding the coverage amount that you need.

Network Hospitals

When selecting an individual health insurance policy, you must check the list of network hospitals of the insurer. Find out if there are any network hospitals near your workplace or home. This will make it easy for you to get cashless treatment in case of a medical emergency.

Affordability

Each of us has a budget when it comes to buying an individual health plan. It is important to consider your expenses and income to decide the amount of premium that you can afford. If you cannot afford a higher premium, you should look for a comprehensive health policy with all the features at a lower premium price.

Check the Sub-Limits

Many individual health policies come with sub-limits on the benefits covered under the plan. It is important to know all the sub-limits so that you do not get any surprises during the claim filing process.

Customer Reviews

Before buying an individual health policy, you must read the reviews of the insurer. This will help you understand the efficiency of the insurance provider when it comes to providing services to the customers.

Network Hospitals

Individual Health Insurance Policy Buying Process

You can buy an individual health insurance policy from the insurance company’s official website as well as from “RenewBuy”. Below mentioned are both the buying process of individual health insurance plans:

Buy from the official website of the insurance company

- Visit the insurance company’s official website and click on the “individual Health Insurance” tab.

- Select the desired plan.

- Fill in all the required information.

- Click on Buy Now button.

- Make payment.

- The insurance company will send the policy documents to your email address.

Buy from “RenewBuy”

- Visit the official website of RenewBuy.

- Click on the “Health Insurance” tab.

- Fill out the form that shows on the next page.

- Compare health plans and select your desired plan.

- Click on the “Buy Now” button

- A pop-up will show you the plan details and the additional riders information.

- Click on the “Proceed to Buy” button.

- Make online payment and the policy documents will be sent to your registered email address.

Documents Required to Buy Individual Health Insurance Plan

Below mentioned are the documents required to buy an individual health insurance plan in India:

- Identity Proof

- Age Proof

- Address Proof

- Medical Report

Individual Health Insurance Claim Process

There are two types of claim settlement processes offered under individual health insurance plans i.e. Cashless claim process and the Reimbursement claim process.

Cashless Claim Process

- Intimate the insurer within 48 hours of hospitalization

- Fill and submit the claim form

- Submit the other necessary documents

- Once the claim is approved, the insurer will settle the medical bills directly with the hospitals.

Reimbursement Claim Process

- Intimate the insurance company

- Collect the original discharge summary.

- Fill and submit the claim form along with the ID proof

- The insurance company will verify the documents

- Once the verification is done, the insurance company will initiate the reimbursement process.

Individual Health Insurance Renewal Process

You can renew your individual health insurance policy via two platforms i.e. online and offline. Read below to understand the renewal process of individual health insurance in detail:

Online Process

- Visit the official website of the insurance company.

- Select "Renewals" from the menu section.

- Enter your policy number and Date of Birth.

- The next page will show you the amount that you need to pay.

- You can also customize your individual mediclaim plan as per your needs.

- Once you did the Renewal payment, your policy details will be sent to your registered e-mail address.

Offline Process

You can visit the nearest branch of the insurance company and renew your policy from there. Also, you can connect with RenewBuy Partners to get assistance for your health plan renewal.